EU Horizon 2020: Financial Supervision and Technology Compliance Training Programme

European knowledge exchange platform for developing and testing Fintech risk management solutions that automatize compliance of fintech companies.

Fintech-ho2020

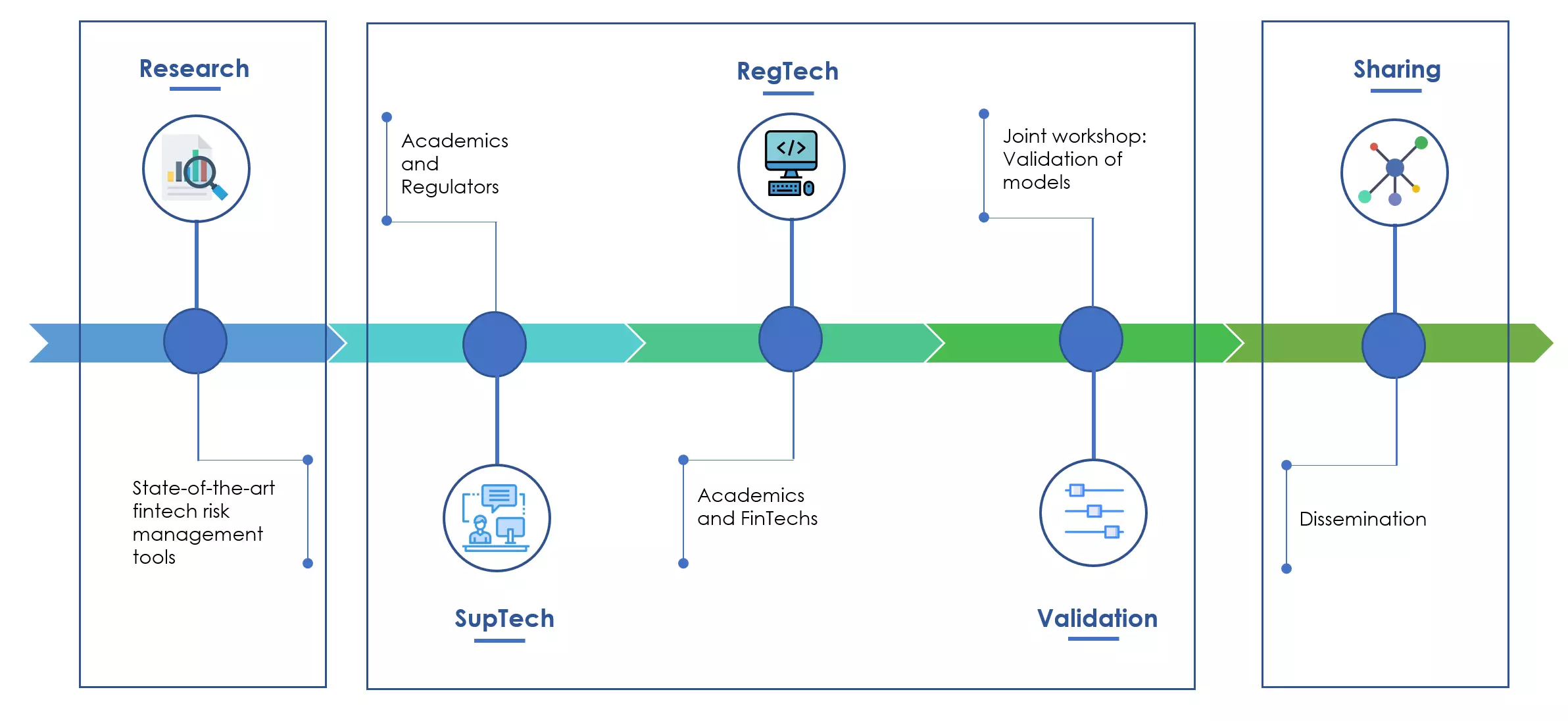

The FinTech-ho2020 is a 2-year project (January 2019 – December 2020) which will develop a European knowledge exchange platform aimed at introducing and testing common risk management solutions that automatize compliance of fintech companies (RegTech) and, at the same time, increase the efficiency of supervisory activities (SupTech). This goal will be pursued through two years of research and dissemination activity, coordinated by independent academic centres, aimed at developing and testing best practices in fintech risk management, to encourage fintech innovations, making them acceptable and sustainable. The final goal of the FinTech-ho2020 project will be to build and test an experimental model which, if successful, will give rise to the launch of Fintech Risk Management European Sandbox (FIRMES) at the beginning of 2021. The knowledge exchange platform envisioned under the FinTech-ho2020 project consists of SubTech, RegTech and research workshops, that will be organized at a variety of locations across Europe, over the period 2019-2020, and will aim to present state of art risk management tools concerning the application of the three main emerging technologies - big data analytics, artificial intelligence and blockchain - in the context of the financial industry.

The Network

The FinTech-ho2020 project is based on a large network of partners and supporters from all European countries, that includes regulatory and supervisory bodies, fintechs and fintech hubs, as well as universities and research centres, and it relies on an international advisory board of experts. Specifically, the partners of the network are research centres and fintechs which have detailed understanding of the risk management models that can be applied to financial technologies and which will be responsible for developing uniform European technology-driven and regulatory compliant risk management procedures. With respect to the project’s supporters, FinTech-ho2020 has gained direct support from national regulatory and supervisory bodies from each EU country and Switzerland.

Big Data Analytics, Artificial Intelligence and Blockchain Research

One of the main objectives of the FinTech-ho2020 project is the creation of new knowledge about risk management models in the application of Big Data Analytics, AI and Blockchain to finance. Specifically, the final repository of the project will contain the research work which all partners of the project undertake for the purpose of increasing the stock of knowledge and understanding of the financial application and the associated risks related with the innovative FinTech processes. The research efforts have the following objectives: (i) establish the state of art concerning the application of big data analytics, artificial intelligence and blockchain in finance, the related risk concerns and the existing risk management models, and (ii) improve risk management standards for the application of big data analytics, artificial intelligence and blockchain in finance by introducing risk management tools which will enable automatized compliance by fintech companies and increased efficiency of the supervisory activities.

SupTech Workshops

The project will create a unified European fintech risk management expertise by delivering SupTech workshops to supervisors and regulators across Europe. Specifically, the sessions will aim at providing shared solutions to automatize fintech compliance. The content of the sessions will cover each of the three main innovative technologies (big data analytics, artificial intelligence and blockchain), their financial application, the main risk concerns and respective risk management tools, which will allow for automated compliance and supervision. The objectives of this specific work package are: (1) to develop common understanding and interpretation concerning the scope, application and risks associated with the applications of: (i) big data analytics, (ii) artificial intelligence and (iii) blockchain; and (2) to develop common expertise concerning the risk management tools that can allow for automated compliance and supervision of FinTech services.

RegTech Sessions

The project also focuses on creating an operational fintech risk management expertise by running practical coding sessions to fintechs which will allow participants to hear and test possible solutions for automatized compliance and supervision. Specifically, these sessions will add the practical aspects of the material covered during the SupTech workshops, through the development of coding examples on publicly available datasets.

Related links: