4th European Conference on Artificial Intelligence in Finance and Industry

We would like to welcome you to the «4th European Conference on Artificial Intelligence in Finance and Industry», hosted by the Institute of Applied Mathematics and Physics (IAMP) and the Institute of Data Analysis and Process Design (IDP) at the School of Engineering (SoE), and the Departement of Banking, Finance, Insurance at the School of Management and Law (SML) at the Zurich University of Applied Sciences (ZHAW) in Winterthur, Switzerland.

Artificial Intelligence in Industry and Finance (4th European Conference on Mathematics for Industry in Switzerland)

September 5, 2019, 9:30-17:45 - ZHAW Winterthur, Technikumstrasse 71, 8401 Winterthur

Information at a glance

- Conference Date: Thursday, September 5, 2019

- Conference Location: ZHAW Winterthur, Technikumstrasse 71, 8401 Winterthur, Eulachpassage (TN)

- Conference Topics: Artificial Intelligence in Industry and Finance

- Conference Flyer(PDF 341,9 KB)

- Conference Program(PDF 470,7 KB)

- Program booklet(PDF 1,5 MB)

- Related Journal: "Frontiers in Artificial Intelligence"(PDF 266,5 KB)

Aim of the conference

The aim of this conference is to bring together European academics, young researchers, students and industrial practitioners to discuss the application of Artificial Intelligence in Industry and Finance.

The 1st COST Conference on this topic was held on September 15, 2016, the 2nd COST Conference was held on September 7, 2017, and the 3rd COST Conference was held on September 6, 2018.

All lectures are open to the public. Registration is now open.

Related Conferences

- Smart Maintenance Conference 2019 (September 3, 2019, Zürich)

- 3. Konferenz Perspektiven mit Industrie 4.0 (September 4, 2019, Winterthur)

- Research Workshop on Credit Risk in P2P Lending Platforms (September 3, 2019, Winterthur)

- RegTech Workshop on AI in Finance (September 4, 2019, Winterthur)

Thematic Sessions

- Artificial Intelligence in Finance: Artificial Intelligence and Fintech challenges for the European banking and insurance industry

- Artificial Intelligence in Industry: Artificial Intelligence challenges for European companies from the mechanical and electrical industry, but also life sciences.

- Big Data and Automation in Finance: This session is devoted to the use of Big Data and Fintech technologies in the ongoing process of automation in the financial industry.

- Ethical Questions in Artificial Intelligence (co-hosted by the Swiss Alliance for Data-Intensive Services): Issues arising in AI applications such as trust, explainability, neutrality, responsibility, moral consequences of algorithmic decisions.

Keynote Speaker

Dr. Carlos Härtel, Science|Business: "Minds & Machines – Towards the Digital Industrial Company"(PDF 2,0 MB)

Invited Speakers

Artificial Intelligence in Finance

- Saeed Amen, CueMacro: "Introduction to Natural Language Processing"

- Prof. Dr. Regina Betz, ZHAW: "Transfers of Kyoto units in the Swiss Emissions Trading Registry: A network analysis from 2007-2014"(PDF 1,6 MB)

- Aleksandra Chirkina, InCube Group, Richard Jeroense, Bank J. Safra Sarasin: "Affinity is in the AIRS: personalized investment recommendations delivered to the clients' E-services"(PDF 1,3 MB)

- Prof. Dr. Matthew Dixon, Illinois Institute of Technology: "Regime Switching Recurrent Neural Networks"

- Dr. Martin Hillebrand, ESM: "Predicting Investor Behaviour in European Bond Markets. A Machine-Learning Approach"(PDF 1,1 MB)

- Dr. Martin Rehak, Bulletproof AI: "AI vs. AI - Intelligent Attacks on Automated Financial Decisions"(PDF 5,0 MB)

- Prof. Dr. Mario Wüthrich, ETH Zürich: "Yes, we CANN!"(PDF 437,4 KB)

Artificial Intelligence in Industry

- Dr. Milos Cernak, Logitech: "Applied Machine Learning at Logitech"

- Christian Fehrlin, Deep Impact AG: "Artificial intelligence will change the world forever"

- Dr. Jochen Klages, Bruker BioSpin AG: "Deep Learning and Spectroscopy"

- Prof. Dr. Milica Kalic, University of Belgrade: "Artificial Intelligence in Air Transport Industry: Airline schedule redesign in a case of disturbance"

- Dr. Nima Riahi, SBB: "Addressing Complex Rail Transport Problems with Artificial Intelligence: The High-Level and the Low-Level"

- Marc Rudolf, Greater Zurich Area: "Korean AI for Swiss Industry"(PDF 2,7 MB)

- Dr. Taikyeong Ted. Jeong: "AI for Behavioral Intelligence and Secure-Open framework (S-OFW) for Connected-Hospital and Factory"(PDF 1,2 MB)

- Michael Rupprecht, Amazon Web Services: "AWS Machine Learning – centerpiece of digital transformation"

- Dr. Peter Staar, IBM: "AI assisted Scalable Knowledge Ingestion for Automated Discoveries"

Special Session "Big Data and Automation in Finance"

- Dr. Jörg Behrens, Fintegral: "Automation in the Financial Industry: The biggest challenges"(PDF 22,1 MB)

- Nils Bundi, Atpar: "Industrialization of finance: the case for an algorithmic financial contract standard"

- Dr. Jean-Marc Eber, LexiFi: "Contract-based Automation for Derivatives"(PDF 895,1 KB)

- Dr. Martin Müller Lennert, Milica Petrovic, InCube Group: "Automated Data Quality Assurance with Machine Learning"(PDF 2,1 MB)

Special session "Ethical Questions in Artificial Intelligence"

- Karin Lange, Die Mobiliar: "Digital Responsibility: It’s all about people, not machines"

- Natalie Pompe, UZH: "AI Innovation in emotional analysis"

- Dr. Teresa Scantamburlo, ECLT: "The AI4EU Observatory on Society and Artificial Intelligence"(PDF 3,3 MB)

- Prof. Dr. Christoph Heitz, ZHAW: "Algorithmic Fairness: A Major Challenge Area for Ethics of Data-Based Business"(PDF 990,5 KB)

- Fidel Thomet, Suntka Rinke: "Computer Pillow Talk" (artistic installation)

Participants

In September 2017 and 2018, we have had around 200 participants, both from Academia and Industry. The latest instalment of the COST conference also saw a large number of international guests and speakers, travelling to Switzerland from destinations such as the UK, Germany, the United States and Bulgaria.

The largest proportion of participants will come from the industry complemented by a significant number of academic researchers. This mirrors our unique approach of connecting the academic world to their respective fields of application, putting new exciting concepts to work in industrial frameworks, where they can open up new opportunities.

Schedule

- Registration, Znüni: 08:30-09:30

- Welcome: 09:30-09:40

- Keynote: 09:40-10:30

- Coffee: 10:30-11:00

- Thematic Sessions 1: 11:00-12:30

- Lunch: 12:30-14:00

- Thematic Sessions 2: 14:00-15:45

- Coffee: 15:45-16:15

- Thematic Sessions 3: 16:15-17:15

- Apéro Riche: 17:15

Detailed Schedule

| Keynote (TN E0.46-54) | ||||

| 09:30-09:40 | D. Wilhelm: "Welcome and Introduction" | |||

| 09:40-10:30 | C. Härtel: "Minds & Machines – Towards the Digital Industrial Company" | |||

| 10:30-11:00 | Coffee (Foyer TN) | |||

| AI in Finance 1 (TS 01.40) | AI in Industry 1 (TN E0.54) | Automation in Finance 1 (TN E0.46) | ||

| 11:00-11:30 | M. Rehak: "AI vs. AI - Intelligent Attacks on Automated Financial Decisions" | C. Fehrlin: "Artificial intelligence will change the world forever" | J. Behrens: "Automation in the Financial Industry: The biggest challenges" | |

| 11:30-12:00 | S. Amen: "Introduction to Natural Language Processing" | M. Rupprecht: "AWS Machine Learning – centerpiece of digital transformation" | N. Bundi: "Industrialization of finance: the case for an algorithmic financial contract standard" | |

| 12:00-12:30 | M. Dixon: "Regime Switching Recurrent Neural Networks" | P. Staar: "AI assisted Scalable Knowledge Ingestion for Automated Discoveries" | J. Eber: "Contract-based Automation for Derivatives" | |

| 12:30-14:00 | Lunch (Foyer TN) | |||

| AI in Finance 2 (TS 01.40) | AI in Industry 2 (TN E0.54) | Automation in Finance 2 (TN E0.46) | Ethical Questions 1 (TN E0.46) | |

| 14:00-14:30 | M. Wüthrich: "Yes, we CANN!" | J. Klages: "Deep Learning and Spectroscopy" | M. Müller-Lennert / M. Petrovic: "Automated Data Quality Assurance with Machine Learning " | |

| 14:45-15:15 | R. Betz: "Transfers of Kyoto units in the Swiss Emissions Trading Registry: A network analysis from 2007-2014" | M. Cernak: "Applied Machine Learning at Logitech" | K. Lange: "Digital Responsibility: It’s all about people, not machines" | |

| 15:15-15:45 | M. Hillebrand: "Predicting Investor Behaviour in European Bond Markets. A Machine-Learning Approach" | M. Rudolf: "Korean AI for Swiss Industry", T.T. Jeong: "AI for Behavioral Intelligence and Secure-Open framework (S-OFW) for Connected-Hospital and Factory" | T. Scantamburlo: "The AI4EU Observatory on Society and Artificial Intelligence" | |

| 15:45-16:15 | Coffee (Foyer TN) | |||

| AI in Finance 3 (TS 01.40) | AI in Industry 3 (TN E0.46) | Ethical Questions 2 (TN E0.54) | ||

| 16:15-16:45 | A. Chirkina / R. Jeroense: "Affinity is in the AIRS: personalized investment recommendations delivered to the clients' E-Services" | M. Kalic: "Artificial Intelligence in Air Transport Industry: Airline schedule redesign in a case of disturbance" | N. Pompe: "AI Innovation in emotional analysis" | |

| 16:45-17:15 | N. Riahi: "Addressing Complex Rail Transport Problems with Artificial Intelligence: The High-Level and the Low-Level" | C. Heitz: "Algorithmic Fairness: A Major Challenge Area for Ethics of Data-Based Business" | ||

| 17:15-18:30 | Apéro riche (Foyer TN) | |||

Dr. Carlos Härtel

A Brief Biography

Dr.-Ing. Carlos Jiménez Härtel is a strategy advisor to private companies and public-sector organizations and holds a number of national and international board assignments. His operational career in industry spans about two decades in a variety of senior leadership roles, most recently as CTO & Chief Innovation Officer for GE Europe and previously as President & CEO for GE Germany. Carlos Härtel has extensive experience in industrial R&D, management of technology transfer and innovation, and the assessment of potential and market readiness of advanced technologies. He studied Aerospace Engineering at RWTH Aachen and TU Munich where he also received his doctorate. In addition, he spent several years in research at the German Aerospace Center (DLR) and at ETH Zurich, where he qualified as University Lecturer in 1999. Carlos Härtel is past President of the European Industrial Research Management Association (EIRMA).

Minds & Machines – Towards the Digital Industrial Company

Advanced digital technologies have become commonplace in many parts of daily life, but only recently started to make noticeable inroads in the industrial sector. Summarized under headlines like “Industry 4.0” or “Factory of the Future”, the suite of technologies relevant to industrial operations includes artificial intelligence and augmented reality, collaborating robots and 3D printing, or cyber-physical systems in general. The talk will give an overview of how industrial companies employ digital technologies today – and in particular AI – on various operational levels in order to increase productivity and improve business outcomes.

Saeed Amen

A Brief Biography

Saeed Amen is the founder of Cuemacro. Over the past fifteen years, Saeed Amen has developed systematic trading strategies at major investment banks including Lehman Brothers and Nomura. He is also the author of Trading Thalesians: What the ancient world can teach us about trading today (Palgrave Macmillan) and is the coauthor of The Book of Alternative Data (Wiley), due in 2020. Through Cuemacro, he now consults and publishes research for clients in the area of systematic trading. He has developed many Python libraries including finmarketpy and tcapy for transaction cost analysis. His clients have included major quant funds and data companies such as Bloomberg. He has presented his work at many conferences and institutions which include the ECB, IMF, Bank of England and Federal Reserve Board. He is also a co-founder of the Thalesians.

An introduction to natural language processing

In this presentation, we shall introduce the topic of NLP. We shall give a brief explanation of the various techniques used, such as word embeddings and topic modelling. We also discuss some of the Python tools that can be used to parse text and perform NLP tasks. We later give several use cases for finance such as the parsing of Fed communications to give an insight into bond yield moves.

Prof. Dr. Regina Betz

A Brief Biography

Prof. Dr. Regina Betz is Head of the Center for Energy and the Environment at the School of Management and Law of the Zurich University of Applied Sciences (ZHAW). Before joining ZHAW she was Joint Director at the Centre for Energy and Environmental Markets (CEEM) at the UNSW Sydney. Regina’s teaching and research interests include energy and climate economics. She also contributes to master courses and consults to industry and government clients in these areas in Europe and Australia. She has been called to appear as an expert witness in climate change issues at various Federal government enquiries and is the co-president of the Swiss National Science Foundation (SNF) National Research Program on Sustainable Economy. Today her research is mainly focusing on the design of climate policies such as emissions trading schemes or energy efficiency obligations as well as electricity markets applying experimental economics or empirical methods.

Transfers of Kyoto units in the Swiss Emissions Trading Registry: A network analysis from 2007-2014

The Swiss emissions trading registry was opened in 2007 and since then companies – including foreign companies - or private persons were able to open an account and transfer units. Such an account enabled to hold and transfer different types of units issued from different jurisdictions including units based on the Kyoto Protocol or emission allowances (CHUs) generated by the Swiss government for compliance under the Swiss Emissions Trading System. The majority of transferred units in the Swiss registry were Kyoto units of the following type: 1) Certified Emissions Reductions (CERs), issued according to the rules of the Clean Development Mechanism (Article 12 des Kyoto-Protocol) and Emission Reduction Units (ERUs), issued according to the rules of Joint Implementation under Article 6 of the Kyoto Protocol.

The aim of this paper is to analyse the transfer flows of both national and international emissions allowances and international emission credits between different accounts in order to gain a picture of Switzerland's role in international emissions trading. We use network analysis to analyse the Swiss registry transfer data from 2007 to 2014. The analysis shows that, contrary to widespread belief, the transfer volume through the Swiss registry was substantial. Although transfers in Swiss emission allowances (CHUs) are negligible, the volumes of CERs and ERUs transferred via the Swiss registry are considerable. According to World Bank estimates the total trading volume of CERs in 2008 amounted to 1 billion, of which approximately 400 million transactions were recorded in the Swiss Registry. The type of actors in both submarkets vary considerably. The market of ERUs is dominated by commodity traders buying large volumes from Russia and the Ukraine, the CER market involves more players from different sectors and is less concentrated.

Aleksandra Chirkina, Richard Jeroense

Aleksandra Chirkina

Aleksandra is a Senior Data Scientist at InCube working on designing and implementing machine learning solutions in the financial industry. She holds an MS degree in Computational Science from UvA (University of Amsterdam) and an MS degree in Statistics from the ETH. She has 2 years of experience in applying data analytics and numerical optimization in industry.

Richard Jeroense

Richard leads the Digitalization and Process Excellence teams at Bank J. Safra Sarasin. They focus on leveraging technology and best practice process management methods to develop new client offerings and enhancing productivity. He holds a Bachelor in Industrial Engineering from the University of Eindhoven (NL), has 14 years’ experience in the Swiss private banking sector, and 10 years’ experience in the industrial and chemical sector across Europe.

Affinity is in the AIRS: Personalized Investment Recommendations Delivered to Clients’ E-Services

Intelligent recommender for investment ideas is highly desirable for a private bank. Besides obvious advantages in providing relevant suggestions and saving the time of relationship managers, it can increase the usage of online banking platforms and improve clients’ engagement. As a part of the Bank J. Safra Sarasin digitization initiative, the AIRS project was launched. Its goal was to design an AI Recommender System for automatic generation of personalized investment ideas. InCube was selected as the fintech partner for the implementation of this system.

The project consisted of two phases: proof of concept and operationalization. Phase I was dedicated to an investigation whether a collaborative filtering approach is applicable for investment ideas at all. Financial data has certain characteristics a recommender should adapt to, such as implicit ratings and changing features of the items. After Phase I was successfully completed, the recommendations were evaluated by Relationship Managers. The goal of phase II was to put the recommendations into a shape deliverable to clients. This meant ensuring agreement with the regulations by imposing quality control, elaborating explanations, reacting to the clients’ feedback, as well as guaranteeing system robustness and reproducibility of results.

Prof. Dr. Matthew Dixon

A Brief Biography

Matthew Dixon is an Assistant Professor in the Department of Applied Mathematics at the Illinois Institute of Technology, where he holds an affiliate appointment in the Stuart School of Business. His research in AI and computational methods for quantitative finance is funded by Intel. Matthew began his career in structured credit trading at Lehman Brothers in London before pursuing academics and consulting for financial institutions in quantitative trading and risk modeling. He holds a Ph.D. in Applied Mathematics from Imperial College (2007) and has held postdoctoral and visiting professor appointments at Stanford University and UC Davis respectively. He currently serves as Editorial Associate for the AIMS Journal of Dynamics & Games, Deputy Editor of the Journal of Machine Learning in Finance and has been a chartered financial risk manager since 2014.

Regime Switching Recurrent Neural Networks

We present a class of Regime Switching Recurrent Neural Networks (RSRNNs), a type of dynamic recurrent neural network for time series prediction which captures different regimes, or hidden states, in the data and provide a multi-modal representation of the residual error. This class of models includes Markov switched models as a special case, where the transitions of states are driven by a hidden $K$-state Markov chain. The MS model also provides simple expressions for the expected duration of each regime. We show experimentally on various financial datasets that these RSRNNs outperform simple RNNs, including GRUs and LSTMs which exhibit dynamic memory but are unable to simultaneously resolve multiple recurrence structures associated with different regimes.

Dr. Martin Hillebrand

A Brief Biography

Martin Hillebrand is a Senior Analyst at the European Stability Mechanism. Prior to joining the ESM, he worked as Quantitative Analyst in the Trading & Derivatives department of Sal. Oppenheim and as Risk Analyst at both Deutsche Bank and the German Finance Agency (Deutsche Finanzagentur). He holds a PhD in Mathematics from the University of Oldenburg. In 2008, he received the Professional Risk Managers International Association (PRMIA) “Award for New Frontiers in Risk Management” for an outstanding research paper. His current research focuses on fixed income markets and credit risk. In addition to his role at the ESM, Martin is a lecturer at the Frankfurt University of Applied Sciences.

Predicting Investor Behaviour in European Bond Markets. A Machine-Learning Approach

The European Rescue Fund ESM has, in its role as financial backstop of the Euro area, a specific interest in a comprehensive understanding of investor behaviour in order to ensure a stable and broad market access.

With numerous transaction data as well as market and macro variables, a learning machine has been trained that forecasts investor demand in syndicated transactions. Out-of-sample tests show already a decent predictive power which is intended to be further improved by intelligent methods of data enhancement.

Dr. Martin Rehak

A Brief Biography

Martin is the CEO and founder of Bulletproof AI. Bulletproof AI builds solution for security of machine learning and statistical techniques applied to credit risk scoring, fraud detection, anti-money laundering and biometric authentication, as well as other AI application domains in finance and security industry. He is also a veture partner with Credo Ventures and an active angel investor in security and enterprise technology fields. Martin has been active in AI & Security fields since 2003. Prior to his ccurrent position, Martin led the Cisco's Cognitive Threat Analytics (CTA) team. CTA was part of the Advanced Threat portfolio and provided advanced threat detection by analysis of network traffic for more than 25 million users worldwide. Prior to his Cisco role, he was the CEO & Founder of Cognitive Security, acquired by Cisco in 2013. Martin holds an engineering degree from Ecole Centrale Paris and a Ph.D. in AI from CTU in Prague.

AI vs. AI - Intelligent Attacks on Automated Financial Decisions

Increasing use of machine learning enables automation and immediate delivery of tasks that were previously tedious, long or even impossible. On the other hand, AI techniques are not magic and, besides other issues, are susceptible to attacks, manipulation and unintentional bias. The attacks against AI can be broken down into three categories. Attacks on confidentiality extract the knowledge stored in the AI models. Evasion attacks use existing vulnerabilities in model definition and training to force unintentional decision of the model. The poisoning attacks are based on model manipulation by introducing carefully crafted training data to influence future model decisions. The current consensus in the research community appears to be that there is no universal solution to make models safe. Therefore, we propose a solution that protects the model from the outside by generative, AI-based threat modeling, intelligent security probing of the model, better training and continuous monitoring of production model behavior for signs of attack or bias.

Prof. Dr. Mario Wüthrich

A Brief Biography

Mario Wüthrich is Professor in the Department of Mathematics at ETH Zurich. He holds a PhD in Mathematics from ETH Zurich (1999). From 2000 to 2005, he held an actuarial position at Winterthur Insurance, Switzerland. He is fully qualified actuary of the Swiss Association of Actuaries, served on the board of the Swiss Association of Actuaries (2006-2018), and is Editor-in-Chief of ASTIN Bulletin.

Yes, we CANN!

We illustrate how we can smoothly transition from classical statistical models (like generalized linear models GLMs) to neural network architectures. In fact, this transition provides us with a natural blending of the data modeling culture with the algorithmic modeling culture (Leo Breiman, 2001), and it allows us to back-test classical statistical models with neural network features. We illustrate this approach on a car insurance dataset.

Dr. Milos Cernak

A Brief Biography

Milos Cernak holds a PhD. degree in electrical engineering from Slovak University of Technology in Bratislava. From 2011 to 2018 he was is a senior engineer and associate researcher at Idiap Research Institute, Martigny, Switzerland. From 2008, he was a member of IBM Research in Prague. After graduating in 2005, he was a post-doc researcher at Institute EURECOM in France, and a principal researcher at Slovak Academy of Sciences. During his studies in 2001, he was also a visiting scientist at Iowa State University's Virtual Reality Application Centre, Ames, USA. Currently he is a principal software engineer at Logitech, CTO-AI group, in EPFL Innovation Park, Lausanne, Switzerland. His research interests include audio and speech signal processing, and applied machine learning. He is a Senior Member of the IEEE.

Applied Machine Learning at Logitech

This talk introduces the work of an AI group at Logitech, focusing on applied audio-visual machine learning. Three use cases are described: i) Keyword Spotting (KWS) systems that are in high demand nowadays as they enable a simple voice user interface to consumer electronics devices, ii) end-to-end accented speech recognition to cope with the absence of given accents in the training set where a voice interface becomes unusable for unseen accents, and iii) audio-visual source separation involving mono-channel audio where source contributions overlap both in time and frequency, applied to video conferencing.

Dr. Nima Riahi

A Brief Biography

Nima Riahi holds an M.Sc. in physics and a Ph.D. in geophysics from the ETH Zurich. He has worked as an R&D specialist in both academic and industrial settings in Zurich, San Diego (CA, USA), and Bern. His focus was originally in the field of sensor array analysis. Since 2017, he was involved in various analytics projects in the rail transport industry, most recently in the domain of delay propagation. He is currently a member of the Research and Innovation Lab at Swiss Federal Railways (SBB), a group that attempts to leverage state-of-the-art technology and research knowledge for rail systems.

Addressing Complex Rail Transport Problems with Artificial Intelligence: The High-Level and the Low-Level

The planning, maintenance, and daily operation of a rail system are complex, interrelated problems involving rolling stock, crew, infrastructure, passengers, and other factors. In the past and today, some of this complexity is addressed by operations research techniques. But new developments in the field of AI and computer hardware allow for new approaches to tackle the hard problems faced by the industry. We give an overview of how the Research and Innovation Lab at the SBB is attempting to address these problems with new strategies and in cooperation with research institutes. An important element of the approach is the creation of a highly scalable rail simulation environment that, among other things, is used to explore avenues for automated train dispatching. We discuss how, for the latter problem, the SBB has launched an international Machine Learning challenge. Other topics that will be covered are optical train localization, the automatic evaluation of solutions to vehicle schedule optimizations, as well as the prediction of technical fault durations and operational perturbation effects.

Christian Fehrlin

A Brief Biography

Christian Fehrlin has been working in the digital world since 1996 and has realized numerous digital and disruptive projects. With Deep Impact he operates an accelerator, which supports companies in innovation and digital transformation.

In addition, he has built his own ventures, which are primarily dedicated to the automated organization of content based on machine learning. When it comes to face recognition, they are among the world leaders. Their solutions are used by banks, governments, industry and large sports arenas.

Artificial intelligence will change the world forever

Artificial intelligence is already being used in everyday life. It gradually takes over tasks in our lives and already helps today with everyday work without us knowing.

What is the current state of technology today and where will artificial intelligence be used in companies today and in the future and how will it change our daily lives and society?

Dr. Jochen Klages

A Brief Biography

Jochen Klages is leading a development group at Bruker BioSpin, a company that manufactures analytical instruments for the life science research. He joined Bruker after he gained his PhD at the TU Munich in NMR spectroscopy. Since then, together with his team, he is developing application software for customers. In recent years the team started an initiative in AI to solve spectroscopic problems with machine learning applications.

Deep Learning and Spectroscopy

In Nuclear Magnetic Resonance (NMR) spectroscopy it is a common task and challenge to detect and interpret the signals in order to be able to answer a chemical question, which requires expert knowledge and experience. These expert skills can to some extent be trained to neural networks.

We at Bruker BioSpin, the major manufacturer of NMR instrumentation, have been working on the application of deep learning in NMR spectroscopy, on tasks like detecting substructure patterns or signal regions in NMR spectra of small molecules. This approach requires a large amount of training data, which cannot be fulfilled entirely by experimental data. To overcome this constraint we chose to use artificial spectra instead.

In this talk, we will present the journey of how we managed to train deep neural nets that perform well on experimental spectra, the challenges we have faced and the lessons we have learnt along the way.

Prof. Dr. Milica Kalic

A Brief Biography

Milica Kalic is a Full Professor and Head of the Air Transport Department, Faculty of Transport and Traffic Engineering (University of Belgrade). Educated at the University of Belgrade (Dipl.ing., MSc. and Ph.D.).

Her main research interest is in airline planning and operations (air network design, airline scheduling, air passenger demand prediction etc), transportation networks, as well as the application of soft computing techniques in the field of transport.

She published over 100 papers in journals and conference proceedings. She participates in different international conferences like ATRS world conference (Air Transport Research Society), EURO (European Conference on Operational Research), EURO Working Group on Transportation, etc. Besides academic and research activities, she's professional engagement includes consulting in projects related to air transport and traffic area.

Artificial Intelligence in Air Transport Industry: Airline schedule redesign in a case of disturbance

Dispatchers who work at the Operations Control Centre react to disturbances (technical breakdown of aircraft or its equipment, crew shortage, lateness of crew and passengers, ATC constraints and restrictions, bad meteorological conditions, etc.) in different ways, but with the same goal: to minimize their negative effects on realization of airline’s planned operations. In order to minimize the negative effects of disturbances, the dispatcher, as a decision–maker, creates a solution and takes appropriate action to implement it within a very short time period. Flight delays, aircraft and crew swapping, flight cancellations, additional flights, using spare aircraft or crew for realization of planned operations, etc. are the actions that dispatcher may use to solve problems caused by disturbances. The complexity of problems caused by disturbance raised, particularly when dispatcher has to deal with more aircraft and rotations.

ASO DSS– Airline Schedule Optimization Decision Support System is developed at the Faculty of Transport and Traffic Engineering – University of Belgrade. In situations when a carrier’s scheduled activities are disturbed, ASO DSS is used to design a new flight schedule within a short period of time, so that minimizes the negative effects of those disturbances.

Milica Kalic will present ASO DSS through the concept description, algorithms used, way implementation, and will also highlight further possible research direction in a sense of the artificial intelligence potentials for application.

Marc Rudolf

A Brief Biography

Marc Rudolf supports Korean companies expanding into Europe by providing relevant information and contacts. His clients range from start-ups to large multinationals. He has broad experience in advising on tax aspects, intellectual property rights and practical issues which become relevant when evaluating Switzerland as a business hub for Europe. Marc has been with Greater Zurich Area AG as a Project Manager and Director for nearly 20 years.

In terms of education and professional experience, Marc Rudolf originally studied German and English literature, later adding a bachelor in economics. He speaks the main European languages including Russian, and is currently learning Korean. Before joining Greater Zurich Area AG, Marc was a journalist for twelve years, then worked for the marketing division of UBS.

Korean AI for Swiss Industry

Korea is one of the countries which is very active in artificial intelligence and its various applications. Marc Rudolf from Greater Zurich Area AG regularly meets AI companies in Korea, promoting the Zurich region as a business location and connecting them with potential partners from both industry and universities. Marc will provide an overview of AI activities in Korea with a view on how Swiss industry could utilize Korean AI for further innovation and market development in Asia.

Dr. Taikyeong Ted. Jeong

A Brief Biography

Prof. Taikyeong Ted. Jeong received the Ph.D. degrees in the Department of Electrical and Computer Engineering from the University of Texas at Austin, in 2004 and working on high performance system, artificial intelligence algorithm, and energy harvesting mobile and system.

Prof. Jeong is currently an Associate Professor at CHA University. Prior to join, he worked at Cisco Systems, Inc,. and was a recipient of the research grants of NASA.

His research interests include computer architecture, artificial intelligence algorithm, hardware/software co-design, and high-performance system design. He is a member of IEEE, IEICE, and IET.

AI for Behavioral Intelligence and Secure-Open framework (S-OFW) for Connected-Hospital and Factory

As a researcher and professor, I will speak in the direction of substantial research and lecture on how artificial intelligence technology and industry can be applied for connected-hospitals and connected-factories, In particular, I discuss . AI algorithms and examples that learn more patterns than can be displayed on the network that the human mindset by behavioral intelligence (BI) is applied. Furthermore, it explains that S-OFW (Secure-Open Framework) is applied to connected-hospitals and connected-industry.

Michael Rupprecht

A Brief Biography

Michael Rupprecht is a Principal Solutions Architect at Amazon Web Services. He has spent his professional career in the software, automotive, and financial services industries; always in IT architect or enterprise architect roles.

AWS Machine Learning – centrepiece of digital transformation

This presentation will provide an overview of the AWS AI Portfolio show how customers are using AI/ML to transform their business in particular how customers use AI/ML services to further personalize their business towards the customer.

Dr. Peter Staar

A Brief Biography

Dr. Peter Staar joined the IBM Research - Zurich Laboratory in July of 2015 as a post-doctoral research fellow in the Foundations of Cognitive Solutions project. The Belgium-born scientist first came to IBM Research as a summer student in 2006.

Prior to joining IBM Research, Peter was a post-doctoral researcher in Theoretical Physics and PASC (Platform for Advanced Scientific Computing) at the Swiss Federal Institute of Technology (ETH) in Zurich, Switzerland.

He earned his PhD in Theoretical Physics and his M.Sc. degree in Physics at ETH Zurich in 2013 and 2009, respectively, and his B.S. degree in Physics (cum laude) from the Catholic University Leuven, Belgium.

Peter has twice been a finalist for the prestigious ACM Gordon Bell award, first in 2013 for his paper entitled "Taking a Quantum Leap in Time to Solution for Simulations of High-Tc Superconductors" and then in 2015 for his paper entitled "An Extreme-Scale Implicit Solver for Complex PDEs: Highly Heterogeneous Flow in Earth Mantle."

In his leisure time, Peter is an active sportsman and photographer who enjoys exploring exotic cultures.

AI assisted Scalable Knowledge Ingestion for Automated Discoveries

Over the past few decades, the amount of scientific articles and technical literature has increased exponentially in size. Consequently, there is a great need for systems that can ingest these documents at scale and make the contained knowledge discoverable. Unfortunately, both the format of these documents (e.g. the PDF format or bitmap images) as well as the presentation of the data (e.g. complex tables and figures) make the extraction of qualitative and quantitive data extremely challenging. In this talk, we will present our three pronged approach to this problem and show practical examples in the field of Material Science and Oil&Gas. We will start by introducing a scalable service [1] that is able to ingest documents at scale and exploits state-of-the art AI models to obtain very high accuracies. Next. we will show how the data contained in the ingested documents can be extracted using NLP methods. Finally, we will show how the extracted data can be efficiently queried using Knowledge Graphs and how one can obtain new insights from these graphs by applying advance analytics [2].

Dr. Jörg Behrens

A Brief Biography

Jörg Behrens is founder and chairman of Fintegral, a consultancy specializing in quantitative risk services for large banking and insurance clients operating out of its hubs in London, Frankfurt, Zurich and New York. Previously, he spent 7 years as partner at EY heading up their FS Global Risk Analytics team and 2 years at Andersen leading their Swiss Quantitative Risk Team. His career also includes 7 years with UBS in London and Zürich where he did focus on quantitative risk management including pricing and validation of derivatives.

Jörg is also non-executive board member at Leonteq chairing their Risk Committee and has previously served in various industry groups including IIF, ISDA and the Swiss Standard Setting Board - at the time when it did develop the Swiss Solvency II framework SST. He received his Ph.D. in particle physics from ETHZ for his work at LEP/CERN.

Automation in Finance

Despite of the digital transformation some people wonder why the “banking revolution” rather looks like a “banking evolution”. However, platforms, process automation and new business ideas continue to transform the financial industry. In this regard the author will share practical experience based on specific examples, and offer a private view on things to come.

Nils Bundi

A Brief Biography

Nils Bundi is core-team member of the ACTUS project, an open source initiative developing an algorithmic representation of financial instruments. Building on ACTUS Nils co-founded atpar AG which developed the ACTUS Protocol, the blueprint for banking-grade finance on blockchain. He also co-founded Ariadne which builds banking tools for both classical and digital assets. Previously, Nils was research associate at Zurich University of Applied Sciences (ZHAW) and “associate” data scientist at ZHAW’s Datalab where he contributed to a wide range of industry projects at the interface of financial data, mathematics, and technology.

Industrialization of finance: the case for an algorithmic financial contract standard

Industrialization has transformed many industries in the past hundred(s) of years like the locomotive, automotive or the shipping industry. Thereby, the adoption of standards and availability of machines has played a key role in driving industrialization. On the other hand, finance has not yet experienced a similar revolution but remained an industry of fragmented systems and manual processes.

In this talk I will present a view on finance as an industry built around financial contracts and argue that, from a technological point of view, this is a formidable basis for industrialization of finance. In particular, the emergence of blockchain and smart contract technology now enables the automation of the lifecycle of financial contracts. However, in order to realize this potential a standardized algorithmic representation of financial contracts is necessary. I will review why financial contracts are the prime candidates for such a representation and discuss requirements on an algorithmic standard. Finally, I will give a brief introduction to ACTUS - an international open-source initiative with the objective to develop exactly this.

Dr. Jean-Marc Eber

A Brief Biography

Jean-Marc Eber is founder and Chief Executive Officer of LexiFi, a software editor providing quantitative applications to financial institutions and technology stacks to leading software editors or information providers. He is a regular speaker at financial engineering conferences and has published papers on financial risk management and on the application of programming language theory to financial trading and risk management. Prior to founding LexiFi in 2001, Jean-Marc was Global Head of Quantitative Research in the Capital Markets Division of Société Générale. In this position, he was responsible for the design and implementation of software tools and mathematical models for trading complex derivative products. After studying economics and mathematics, he holds a PhD in mathematical economics from the University of Bonn. Jean-Marc lectured at various french academic institutions financial risk theory and management.

Contract-based Automation for Derivatives

Standardizing derivative contracts is an illusion, as one of finance industry main goals is to adapt to ever changing market situations or perceptions. Financial institutions, market participants, technology providers, policy makers and regulators should instead concentrate on standardizing the method for describing ever new financial contracts. Designing such a generic description framework is a surprisingly challenging task, if one is looking for a workable solution that can be applied from the simplest to the most intricate financial contracts.

We argue that a formal description of complex financial contracts is both desirable and practical, as illustrated by an existing and field-proven implementation. Moreover, we show that such a standardized specification of financial contracts enables a business to unleash the full spectrum of innovation, while controlling costs and operational risks.

We discuss the main requirements of any formal language used to describe the behavior of financial contracts and their life-cycle, and show how long-standing problems in the industry can be efficiently solved by using such a formalism.

Dr. Martin Müller Lennert, Milica Petrovic

Dr. Martin Müller Lennert

Dr. Martin Müller-Lennert is a Senior Data Scientist at InCube. He has implemented machine learning solutions in the financial industry and worked on the development of InCube's wealth tech platform. He holds both a PhD and a master’s degree in mathematics from ETH Zurich.

Milica Petrović

Milica Petrović is a Senior Data Scientist at InCube. She has professional experience applying data modelling and AI in the financial industry, working on projects from design to implementation. She holds an MSc degree in Statistics from the ETH.

Automated Data Quality Assurance with Machine Learning

Companies store massive amounts of data to derive business value from it. However, data quality issues limit the usefulness of the data. Typical issues include missing values, wrong formats, or incorrect values. The usual approach to overcome them is to implement hard-coded rules on the database entries to ensure their correctness. However, this approach is not universally applicable and does not scale.

Machine learning provides ways to significantly improve and speed up error detection, without the need to explicitly specify hard-coded rules. The secret is autoencoders – neural networks that model and reconstruct their own input. When adequately trained, they only reconstruct clean data, which exposes corrupted entries.

Automation allows for an extension from error detection to error remediation. Using Robotic Process Automation combined with AI, also known as Intelligent Process Automation (IPA), companies can correct some types of identified errors without human involvement. To achieve this goal, IPA systems leverage not only structured data, but also unstructured data such as scanned documents.

We apply autoencoders for detecting errors on production data and are developing IPA systems for correcting them. Alongside the specific algorithms for different data types and our findings, we will present a small demo application.

Karin Lange

A Brief Biography

Karin Lange is Head of Corporate Foresight Management – and thus part of the Innovation department at Swiss Mobiliar. Responsible for Trend Scouting, Trend Monitoring and prospective scenario building based on the trend findings, Karin works with interdisciplinary teams within the company to explore risks and opportunities of new business fields for her company.

Prior to this position she was part of the Corporate Social Responsibility team at Swiss Mobiliar, focusing strongly on the question of Corporate Digital Responsibility. Karin accumulates 20+ years of experience in various positions, departments, industries and countries. She graduated with a Master in Political Sciences and Linguistics from the University of Konstanz.

Since 2016 Karin is the Industrial leader for the Expert Group “Data Ethics” within the Swiss Alliance for Data Intensive Services.

Digital Responsibility: It’s all about people, not machines

Data Ethics and Data Privacy have been named among the top 10 trends for 2019 by Gartner and Karin explores and develops these issues both at Swiss Mobiliar and the Swiss Alliance for Data Intensive Services. Big potential and high risk at the same time, the social implications of big data and artificial intelligence have to be thoroughly examined.

Together with different Swiss universities and companies, the Expert Group “Data Ethics” has developed an “Ethical Code of Conduct for Data-Based Value Creation” which will be presented at the conference.

Natalie Pompe

A Brief Biography

Natalie Pompe is currently finishing her PhD at the University of Zurich in which she analysed the consequences of algorithmic information distribution on the democratic discourse in Switzerland. She has been working at the Berkman Klein Center at Havard Law School on research projects concerning the legal and ethical questions in AI innovation as well as global governance questions. Among other activities, she is also the legal advisor of an emerging Swiss AI start-up and she is part of the We-Publish NGO that creates a decentralised publishing infrastructure for journalists and a new media-currency.

AI Innovation in emotional analysis

AI is disrupting different industries and will change the way we live. The newest self-learning technologies promise to identify emotional states and make predictions about human intentions. Companies such as “emotion-intelligence” evaluate unconscious behaviour through the web and are used for commercial purposes. Voice analysis and language analytics are emerging in order to better classify and understand human behaviour on the emotional level. Legally speaking, this innovation triggers various questions. The concerns that scholars had with Big Data analytics and new profiling techniques situated on the intersection of personal data protection and autonomy are now elevated on a more sensitive level. – More so, the AI innovation on the level of the human psyche triggers ethical as well as sociological questions. In this short talk Natalie Pompe will outline a few legal challenges and address the pitfalls of traditional legal instruments in responding to emerging AI innovations. Furthermore, she will continue to apply the international ethical guidelines in AI innovation to a few examples from the start-up industry to illustrate the legal and ethical challenges.

Dr. Teresa Scantamburlo

A Brief Biography

Teresa Scantamburlo is a post-doctoral researcher at the European Centre for Living Technology (ECLT), Ca’Foscari University, Venice (Italy). She has worked at the University of Bristol and now is involved in the European Project AI4EU. Her research interests lie at the intersection of Philosophy and Artificial Intelligence (AI). Currently she is working on the social and ethical impact of AI, in particular, on human decision-making and social regulation.

The AI4EU Observatory on Society and Artificial Intelligence

In this talk I will present the Observatory on Society and Artificial Intelligence (OSAI), an activity that is part of AI4EU, an ambitious H2020 project that gathers 80 partners across Europe. The AI4EU Observatory has been created to support discussion and facilitate the distribution of information about the Ethical, Legal, Socio-Economic and Cultural issues of AI (ELSEC-AI) within Europe. I will outline the main activities of OSAI and sketch out other relevant European initiatives, such as the High-Level Expert Group’s Ethics Guidelines. The main goal of this presentation is to make sense of the European stance on ELSEC-AI discussing valuable achievements and critical issues.

Prof. Dr. Christoph Heitz

A Brief Biography

Christoph Heitz is professor for Operations Management at the Institute of Data Analysis and Process Design (IDP) at Zurich University of Applied Sciences. His research areas include data-based decision making in business processes, data-based service innovation, and ethics in Machine Learning.

After a PhD in Theoretical Physics (University of Freiburg, German), he worked in software industry and in industrial research before joining ZHAW in 2000.

In 2017, he co-founded the Swiss Alliance for Data-Intensive Services (data+service), and serves as its president since then. Data+service is a Swiss national innovation network consisting of more than 40 companies and more than 20 research institutions, involving more than 300 researchers and professionals. Its goal is to foster innovation in the field of data-based services in Switzerland, by establishing cooperation within its interdisciplinary expert network of innovative companies and universities, combining knowledge from different fields into marketable products and services.

Algorithmic Fairness: A Major Challenge Area for Ethics of Data-Based Business

Apart of the issue of data privacy, the second large area of ethical challenges in data-based business is the question of which impact data-based algorithms have on the lives of people and on society as a whole. Basic societal values such as equality, freedom, or justice are on stake, and often threatened, by data-based decision making systems. Algorithmic Fairness (or Algorithmic Bias) is a major issue - many recent examples show that algorithms may systematically discriminate against specific groups, which, in most cases, happens unintentionally. Often, involved companies face major reputation problems, and algorithmic bias is already not only an ethical issues, but a large reputation risk factor in an increasingly algorithm-controlled world.

In my talk, I will give an overview on the state of the art in Algorithmic Fairness. I will show that this problem only be solved by consistently combining an ethical methodology (discourse about “What is fair?”) with an engineering solution methodology (“How to create fairness in algorithms?”).

Computer Pillow Talk

Computer Pillow Talk, 2019

Fidel Thomet, Suntka Rinke

Have you ever asked yourself the question “If machines and big data companies wouldn’t listen to our conversations and posts – it would be the other around? What would they talk about?”

Fidel Thoma and Suntka Rinke are exploring this topic with this installation by turning the roles of subject and object. They enable us humans to spy on two intelligent machines having a conspirational conversation.

Fidel Thomet is an interaction designer focused on visualising complex systems. He currently works on communicating climate change scenarios and does his master in urban futures at University of Applied Sciences Potsdam.

Suntka Rinke is an interaction designer, mathematician and project manager. Her work focuses on speculative critical design and computational explorations. She currently pursues her master of interaction design at the Zürich University of the Arts.

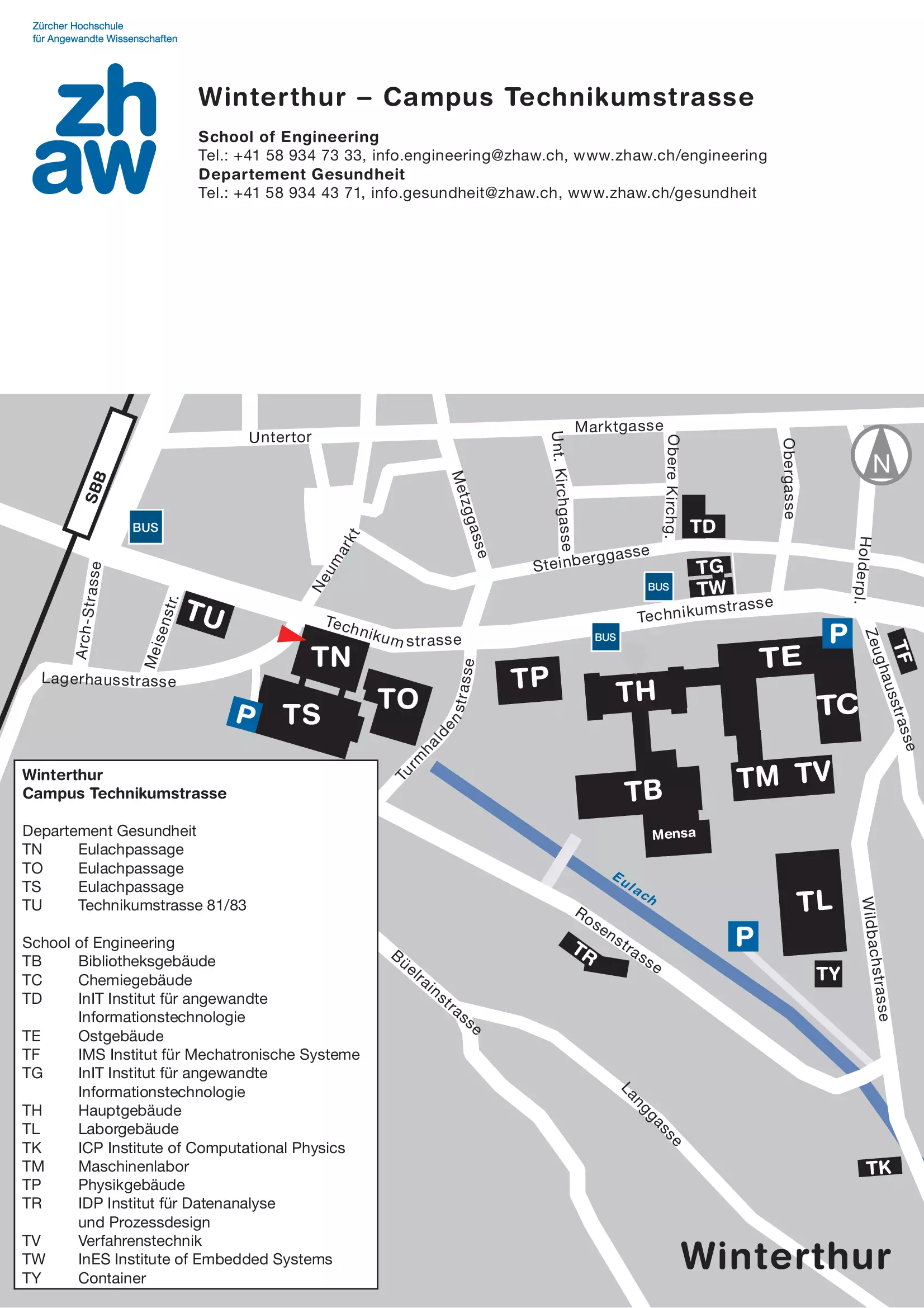

Location

The conference venue is situated at a walking distance from the station.

Travel to ZHAW School of Engineering, Winterthur

From the Zürich airport local transport brings you to the centre of Winterthur in just 20 minutes.

The conference takes place in a short walking distance to the train station. Numerous hotels in the immediate vicinity will ensure a pleasant stay in Winterthur

By train

The trains run as often as every 15 to 20 minutes from Zürich Airport and Zürich City and take about 15 minutes to arrive in Winterthur.

From the main railway-station, the conference location can be reached within a walking distance of less than 5 minutes.

By Car

Location

Organizing Committee

- Prof. Dr. Jörg Osterrieder

- Prof. Dr. Dirk Wilhelm

- Prof. Dr. Rudolf Füchslin

- Dr. Andreas Henrici

- Prof. Dr. Peter Schwendner

- Prof. Dr. Wolfgang Breymann

Program Comittee

- Prof. Dr. Jörg Osterrieder

- Prof. Dr. Dirk Wilhelm

- Prof. Dr. Wolfgang Breymann

- Prof. Dr. Ruedi Füchslin

- Dr. Andreas Henrici

- Prof. Dr. Peter Schwendner

- Prof. Dr. Marc Wildi

- Prof. Dr. Christoph Heitz