Associate in Reinsurance (TM) ARE

At a Glance

Degree: Associate in Reinsurance™ (The Institutes)

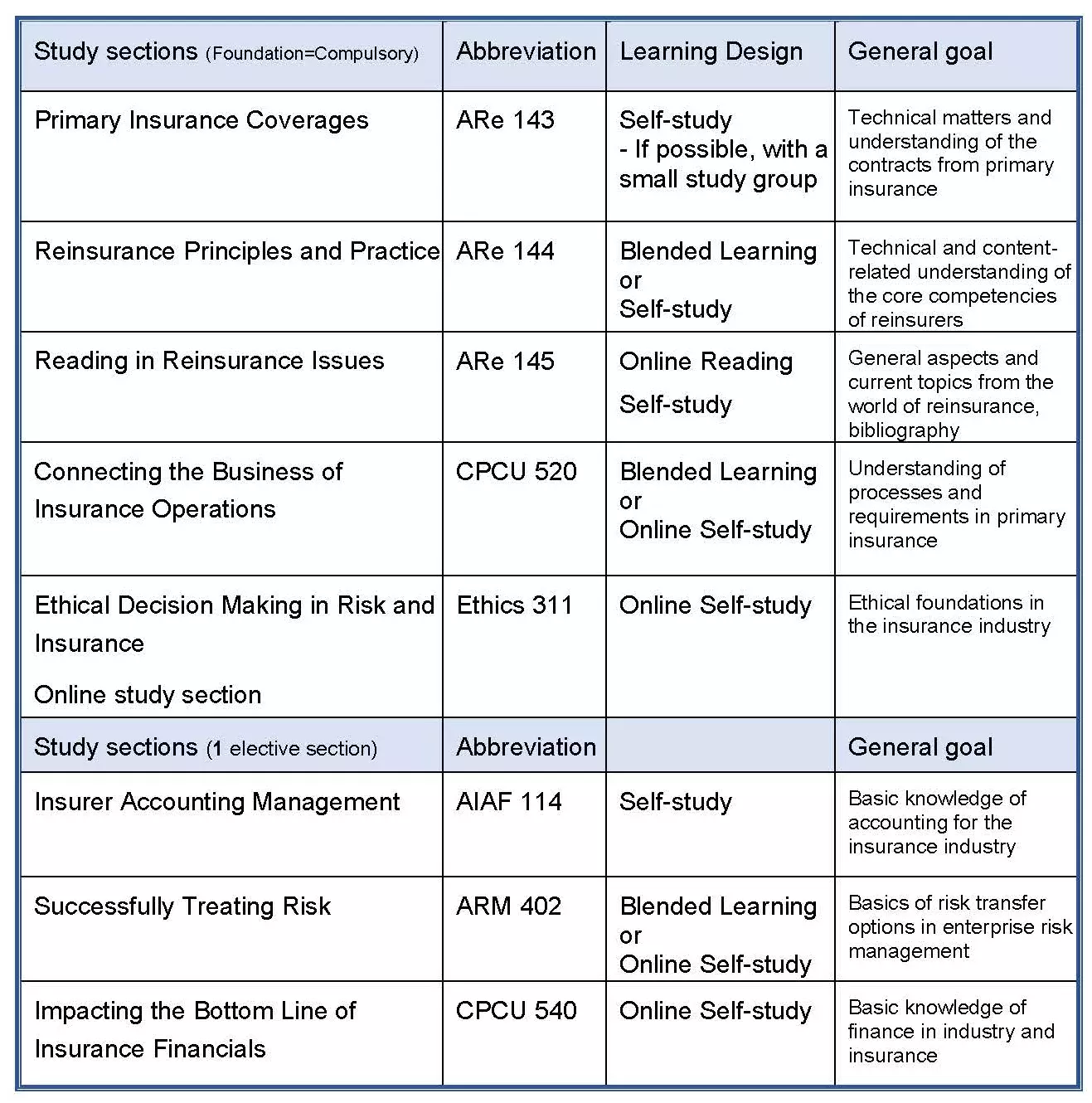

- ARe 143: Primary Insurance Coverages

- ARe 144: Reinsurance Principles and Practice

- ARe 145: Readings in Reinsurance Issues and Developments

- CPCU 520: Connecting the Business of Insurance Operations

Duration: Approximately two years for the complete designation, with considerable flexibility in terms of how the course is structured.

Language of instruction and materials: English

Objectives and Contents of the Study Sections

The "Associate in Reinsurance" course consists of four core subjects and one additional elective module that is designed to complement your professional focus.

There is also a short compulsory section on ethics. If you have already completed this as part of another diploma from The Institutes, you will not have to take it again.

The order of the study sections can be chosen freely. Of course, you can also register for individual subjects on their own.