Sustainable Investments Failing to Meet Customer Expectations

Sustainable investments are becoming increasingly popular with residents of Switzerland. Two out of three people want their Pillar 3a financial investments to be sustainable. However, a ZHAW study reveals that these investment products seldom translate into a sustainable effect.

At the end of 2021, Pillar 3a pension capital in Switzerland amounted to CHF 142 billion, with around a third of taxpayers paying into a Pillar 3a product annually. Two-thirds of them want to invest their money sustainably. In contrast to pension funds, Pillar 3a savers decide for themselves how they want to invest.

This considerable demand for sustainable investment is matched by a broad and diverse range of financial products. However, according to a study conducted by the ZHAW School of Management and Law on behalf of the Federal Office for the Environment (FOEN), these offers rarely meet the expectations of Switzerland’s customers today.

To this end, ZHAW researchers evaluated all the approximately 150 current Pillar 3a products that providers are required to register with the tax authorities.

Mismatch Between Expectations and Products

In recent years, sustainable investments have undergone an enormous boom and developed from a niche to a mainstream financial product. “At the same time, however, accusations of greenwashing have repeatedly emerged,” comments Dr. Dominik Boos, Lecturer and Specialist in Asset Management at the ZHAW School of Management and Law.

Customers expect sustainable investments to impact environmental sustainability, but the products on offer seldom meet this expectation. In particular, pure ESG (environmental, social, and governance) products only analyze financial risk – how environmental risks, for example, might affect a company’s profitability. Impact-oriented investment requires the opposite approach – an analysis of how a company’s commercial activities affect the environment.

“If investors are unaware of this difference, they think they are investing in an impact-oriented manner when they are not. This can lead to accusations of greenwashing,” continues Dominik Boos.

Lacking Sustainability and Clarity

According to the Federal Council’s position on greenwashing prevention from December 2022, only what contributes to a sustainability goal – or is at least compatible with it – should be considered sustainable in the future. Purely risk-oriented strategies can no longer be described as sustainable simply because they minimize financial risk. According to the ZHAW study, two-thirds of pension capital is in savings accounts or tied up in life insurance policies.

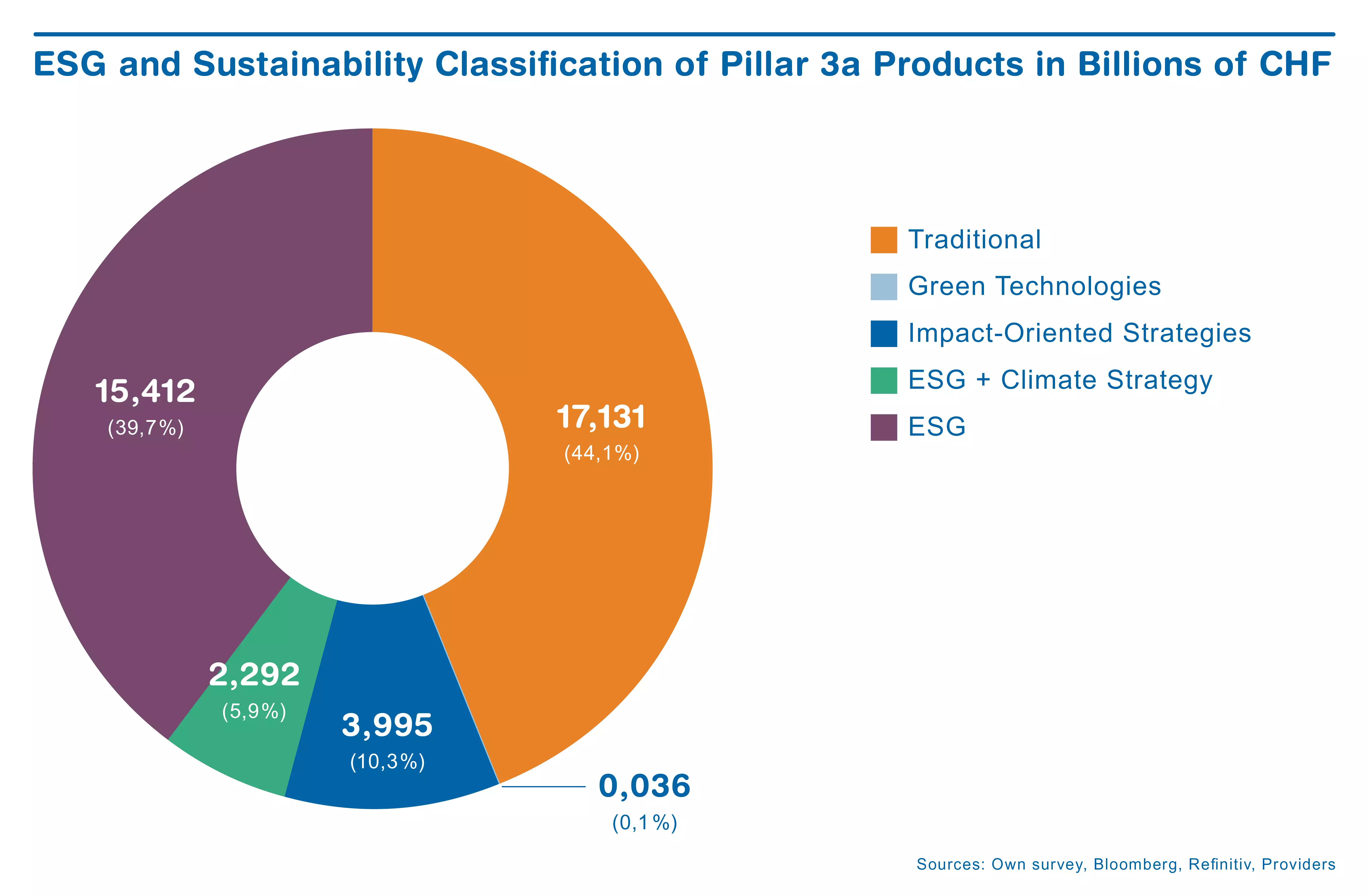

“Pillar 3a investments are, therefore, generally very risk-averse,” explains Dominik Boos. Only around 30 percent is in securities that could potentially be invested sustainably, and more than half of these investments now describe themselves as sustainable or “ESG.” However, only 10 percent of these strive for a sustainable effect and can be described as sustainable according to the Federal Council’s position and customer expectations.

“Another problem with sustainable Pillar 3a products is their lack of transparency and comparability. Funds still report very inconsistently on their sustainability approaches,” says Boos. In addition, sustainability motives are hardly ever explicitly declared, and sustainability goals are not formulated. “In addition to this, it is often unclear whether the focus is on the climate, the environment in general, or social issues.”

Recommendations for Greater Sustainability

The ZHAW study describes how the Federal Council’s position on greenwashing prevention could be implemented for Pillar 3a products. This would require a stringent approach that focused on impact-oriented sustainability. According to Dominik Boos, the most promising solution would be to differentiate between economic sectors in a so-called sector approach.

“An oil producer no longer playing a role in the transformed economy has no place in a sustainable portfolio. However, it is better to engage with a car manufacturer whose products remain important and try to persuade them to adopt a more sustainable business model.” In addition, greater transparency and a holistic survey of customer preferences would facilitate decision-making.

The ZHAW study, therefore, proposes a concept for how sustainability preferences can be surveyed at the same time as financial preferences, so that customer expectations are better and more consistently met.

Contact

- Dr. Dominik Boos, ZHAW School of Management and Law, phone +41 58 934 77 30, e-mail: dominik.boos@zhaw.ch

- Silvia Ruprecht, FOEN, phone +41 58 462 60 30, e-mail: silvia.ruprecht@bafu.admin.ch

- Valerie Hosp, Communications, ZHAW School of Management and Law, phone +41 58 934 40 68, e-mail: valerie.hosp@zhaw.ch