Master of Science in Real Estate and Facility Management

With the Master of Science in Real Estate & Facility Management: Understand real estate, lead employees, inspire innovation, implement sustainability, apply economic principles.

Why pursue a Master's degree in Real Estate and Facility Management?

With this qualification, you can obtain a management position with a high level of responsibility in the strategic areas of real estate and facility management. You can make things happen, become a relationship manager and benefit from exciting career prospects.

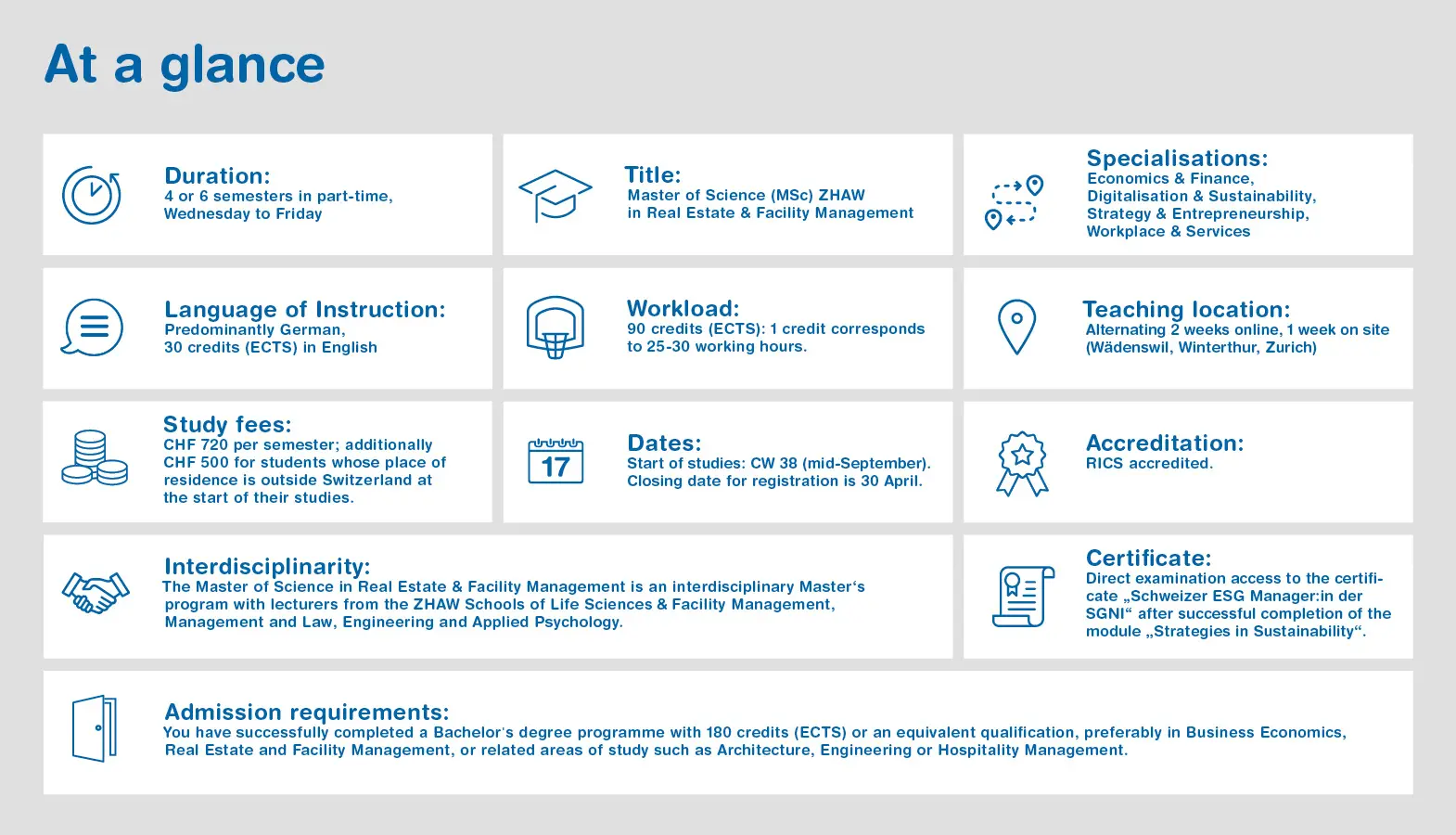

The Master of Science in Real Estate & Facility Management is an interdisciplinary Master's program with lecturers from the ZHAW Schools of Life Sciences & Facility Management, Management and Law, Engineering and Applied Psychology. It is the first Master's programme in Switzerland to combine the fields of real estate and facility management, economics, finance, operational technology/IT and services with a focus on the key issues of sustainability and digitisation. This in turn makes our graduates highly sought-after candidates in the job market. They know what drives the industry and possess the problem-solving skills that are needed in today's labour market.

"Be part of sustainability transformation throughout the real estate life cycle - strategically, holistically and with an awareness of economic principles."

Prof. Dr. Isabelle Wrase FRICS, Programme Director, MSc Real Estate & Facility Management

Your profile

You are fascinated by topics such as: Corporate and Public Real Estate Management, Sustainability in Construction and Operations, Digital Facility Management, Building Information Modelling (BIM), Computer Aided Facility Management (CAFM), REFM-compliant Construction Planning, Life Cycle Costs, Strategy Development, Change Management, Leadership, Investments, Sustainability, Urban Mobility, Workplace Management, Service Design, Customer Journey, Benchmarking, Processes, Engineering, Smart Experience, Data Management, Real Estate Valuation, Real Estate Markets, Real Estate Financing, Real Estate Investments and Real Estate Development.

You have a Bachelor's degree preferably in: Facility Management, Real Estate Management, Business Administration, Architecture, Engineering or Hospitality Management.

Career: Holding a Master's degree in in Real Estate & Facility Management will allow you to...

Basis for a career with excellent career prospects: Competent specialists and leaders in Real Estate and Facility Management are in great demand, due not only to growing cost pressures, but also to increasing environmental awareness. In both private companies and public sector enterprises, there is a high demand for professionals with in-depth know-how regarding the sustainable planning and management of real estate, as well as the design and optimisation of services.

Whether you start your own start-up or work for a facility service provider, a pharmaceutical company, a construction firm, a health care professional, a real estate company, a bank or a public institution, your career opportunities are varied and have great prospects. For example as:

- Corporate Real Estate Manager

- Head Procurement

- Real Estate Appraiser

- Lead Sustainability

- Digital Innovation Manager

- Real Estate Portfolio Manager

- Workplace Manager

Good reasons for studying for a Master of Science in Real Estate and Facility Management (MSc REFM) at the ZHAW

- With the MSc REFM, you are well equipped for the challenges of the real estate and facility management industry and have excellent career prospects.

- You study with a practical orientation and can choose from three specialisations.

- You can work 50 to 70 percent while you study. You study part-time for four or six semesters, every Wednesday to Friday.

- We teach using the blended learning approach. Two weeks online, one week on-site.

Course content and progression

The Master’s degree combines independent learning with face-to-face and online lessons. Students prepare for face-to-face teaching in self-study using written material, learning videos, etc., and practical case studies. In the on-site and/or online contact lessons, the previously learned content is consolidated and applied, and questions are discussed.

There is a choice between four specialisations.

Economics & Finance

Due to the increasing prominence of institutional investors in the real estate market, active real estate portfolio management and strategies for investment, disinvestment and optimisation are becoming increasingly important. Training paths which specialise in finance have become indispensable due to the growing significance of real estate assets in the capital market. Topics such as real estate financing as well as valuation and transaction management are therefore becoming increasingly important in the real estate sector.

Digitalisation & Sustainability

Sustainable development is the great challenge of our time, and digital transformation can be the key to a more sustainably built environment in real estate and facility management. This in-depth specialisation brings these two developing trends in the real estate industry together and examines the synergies that exist between them.

Workplace & Services

This specialisation will enable you to design sustainable solutions at the interface of space, productivity, well-being and service. You will learn to develop innovative workplace strategies, efficiently design and manage operational processes and projects relating to workplaces and implement contemporary service concepts in facility management. The ability to create solutions in the areas of workplace, services and hospitality from a customer and user-orientated perspective prepares you for future challenges in the real estate and facility management sector.

Strategy & Entrepreneurship

Plan your studies individually , choosing from the extensive range of courses offered in the Economics & Finance, Digitalisation & Sustainability and Workplace & Services specialisations.

Your new skills and competencies:

- Be entrepreneurial and develop strategies and innovative solutions.

- Clearly show the economic benefits of investments.

- Transform existing infrastructures and processes sustainably.

- Effectively dealing with disruptive challenges in companies and start-ups, innovating and creating compelling customer experiences, with the help of digital solutions.

- Create and make use of well-founded, quantitative data analyses as a basis for decision-making.

This module table is valid from 1. September 2025

Legend

Specialisation Workplace & Services

Specialisation Digitalisation & Sustainability

Specialisation Economics & Finance

Specialisation Strategy & Entrepreneurship

Compulsory modules

Elective modules

4. Semester, ECTS: 20

3. Semester, ECTS: 20

2. Semester, ECTS: 25

International Mobility

Are you interested in taking an international approach to your studies? We offer an attractive learning environment for this: whether you attend an exchange semester or a summer or winter school at a partner university - we will be happy to advise you and provide you with unique experiences.

This might also interest you

CV-Check

Are you interested in a Master's degree program and would like to know whether you meet the requirements?

Registration Master's programme

CV-Check

Organise your studies

Ready for a new chapter in your life? Apply now.

Are you interested in a Master's degree program and would like to know whether you meet the requirements?

Fees, important dates, timetables and the Study App at a glance.