Data Driven Financial Risk and Regulatory Reporting (DaDFiR3)

At a glance

- Project leader : Prof. Dr. Henriette Elise Breymann

- Project team : Dr. Patrick Hauf, Donat Maier, Dr. Francis Parr

- Project budget : CHF 1'499'998

- Project status : ongoing

- Funding partner : SNSF (BRIDGE Discovery / Projekt Nr. 203617)

- Project partner : Universität Zürich / Institut für Banking und Finance, Hochschule Luzern

- Contact person : Henriette Elise Breymann

Description

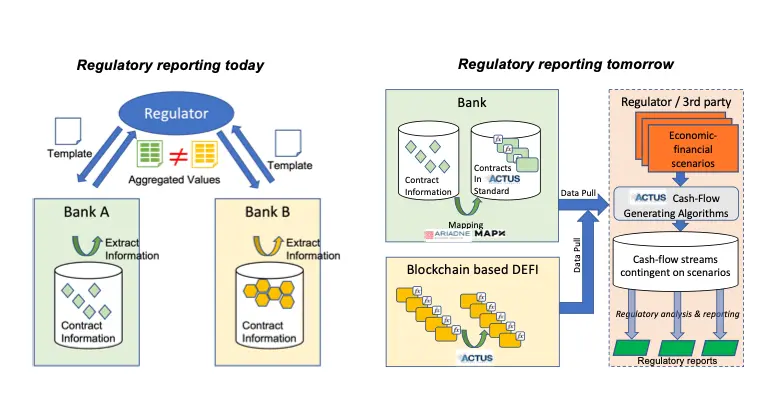

DaDFiR3 pursues the vision of a system for automated regulatory financial reporting that uses financial contract-level data combined with market data to automatically produce the analyses required for internal and external oversight.

Content and objective

We will deploy an ICT infrastructure that provides a suitable ecosystem for forward-looking financial simulation and analysis. We further develop the financial mathematical toolset for risk analysis. Key elements of our technology are:

- a common logic for the digital representation of financial contracts based on the ACTUS standard;

- a privacy-preserving way for maintaining and operating the financial contracts on a decentralized finance architecture leveraging the blockchain technology;

- Big Data technology for the processing and analysis of large-scale contract information;

- state-of-the-art financial analytics, given the users’ granular contract data.

This infrastructure enables largely automated, situational risk assessment of individual financial institutions (microprudential supervision) and, eventually, of the entire financial system (macroprudential supervision).

Scientific and societal context

Effective and efficient financial regulation is essential for a stable financial system and thus for the whole economy and society. The financial crisis of 2007-2009 demonstrated a lack of ready-to-use risk assessment tools at the disposal of financial institutions and supervisors alike. A harmonized granular data standard and analytics architecture that facilitates financial reporting and stress testing is required to enhance the resilience of the financial system. With the new infrastructure, regulatory financial reports can be flexibly adapted to the respective needs and quickly produced. The considerable costs that banks currently incur will be significantly reduced through automation. At the same time, the new DeFi area allows a broad adoption of the developed framework. The ultimate goal is to create an automated system similar to the worldwide daily weather forecast.