Every Second Online Payment is now Mobile

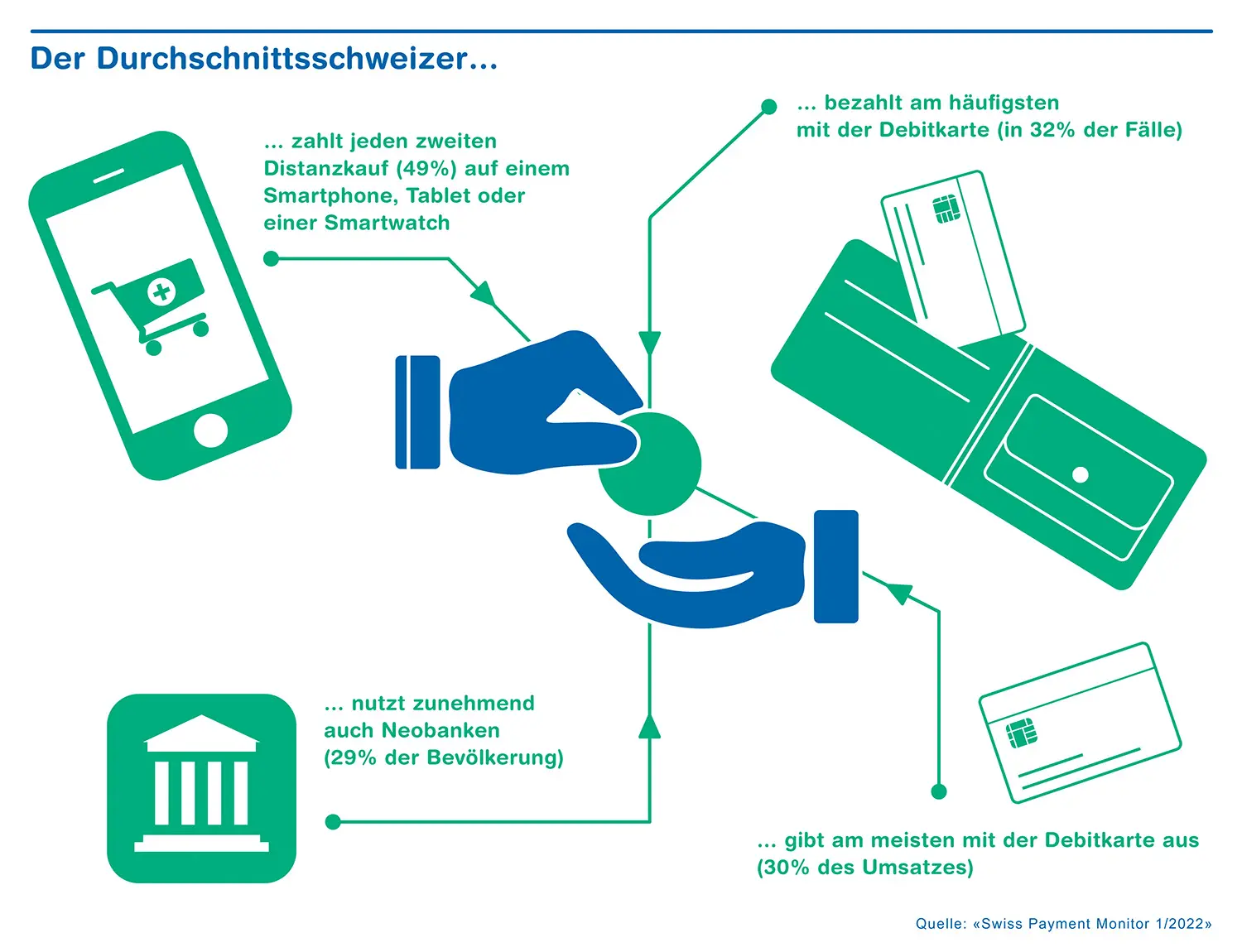

Around half of all online payments today are made using devices such as smartphones and tablets. In addition, around 30 percent of the Swiss population now use neobanks. These are the findings of the latest Swiss Payment Monitor issued by the Zurich University of Applied Sciences (ZHAW) and the University of St. Gallen.

The Swiss population frequently uses a mobile device to pay for goods and services not purchased directly in a store or restaurant – 49 percent of all transactions in what is known as distance selling take place via a mobile phone, tablet, or smartwatch. This includes payments directly from a bank account, such as with TWINT, and in-app credit or debit cards, such as with Apple Pay or SBB Mobile. These are the findings of the sixth Swiss Payment Monitor carried out by the ZHAW School of Management and Law and the University of St. Gallen. For this study, 1,460 people representative of the whole of Switzerland were surveyed at the end of 2021.

Many in-app purchases

A year ago, mobile payments accounted for 29 percent of all distance purchases. "The big growth is mainly due to payments in apps with integrated payment functions, such as SBB Mobile. These now account for more than half of all mobile distance purchases," explains ZHAW payments expert Marcel Stadelmann. The second most common method of distance payment is by invoice (26 percent), followed by non-mobile credit card use (10 percent). Mobile payments also nearly doubled in total sales of all distance purchases last year: The share is now around one quarter. This puts mobile payment solutions in second place behind invoices (45 percent) and ahead of non-mobile credit card use (17 percent).

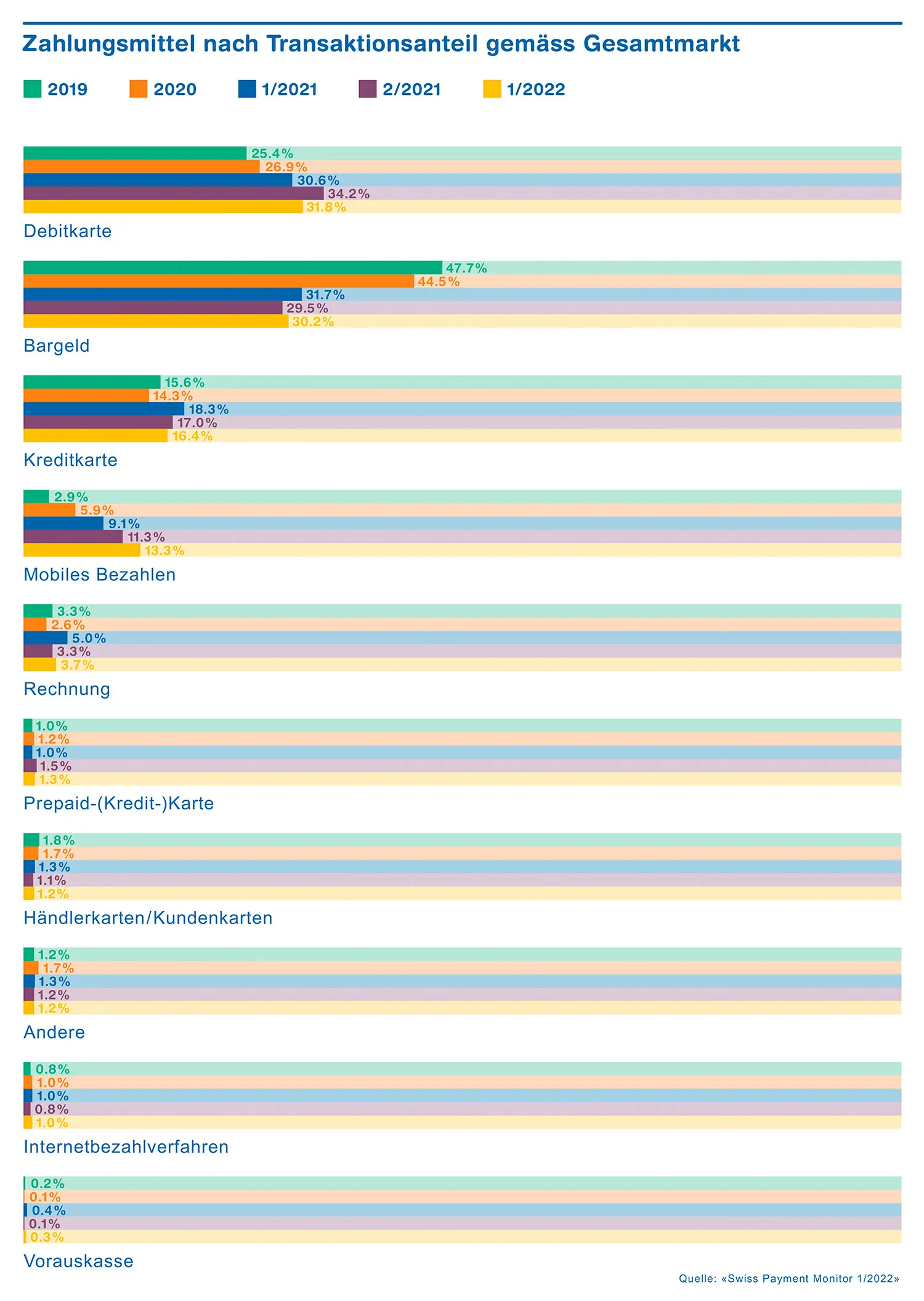

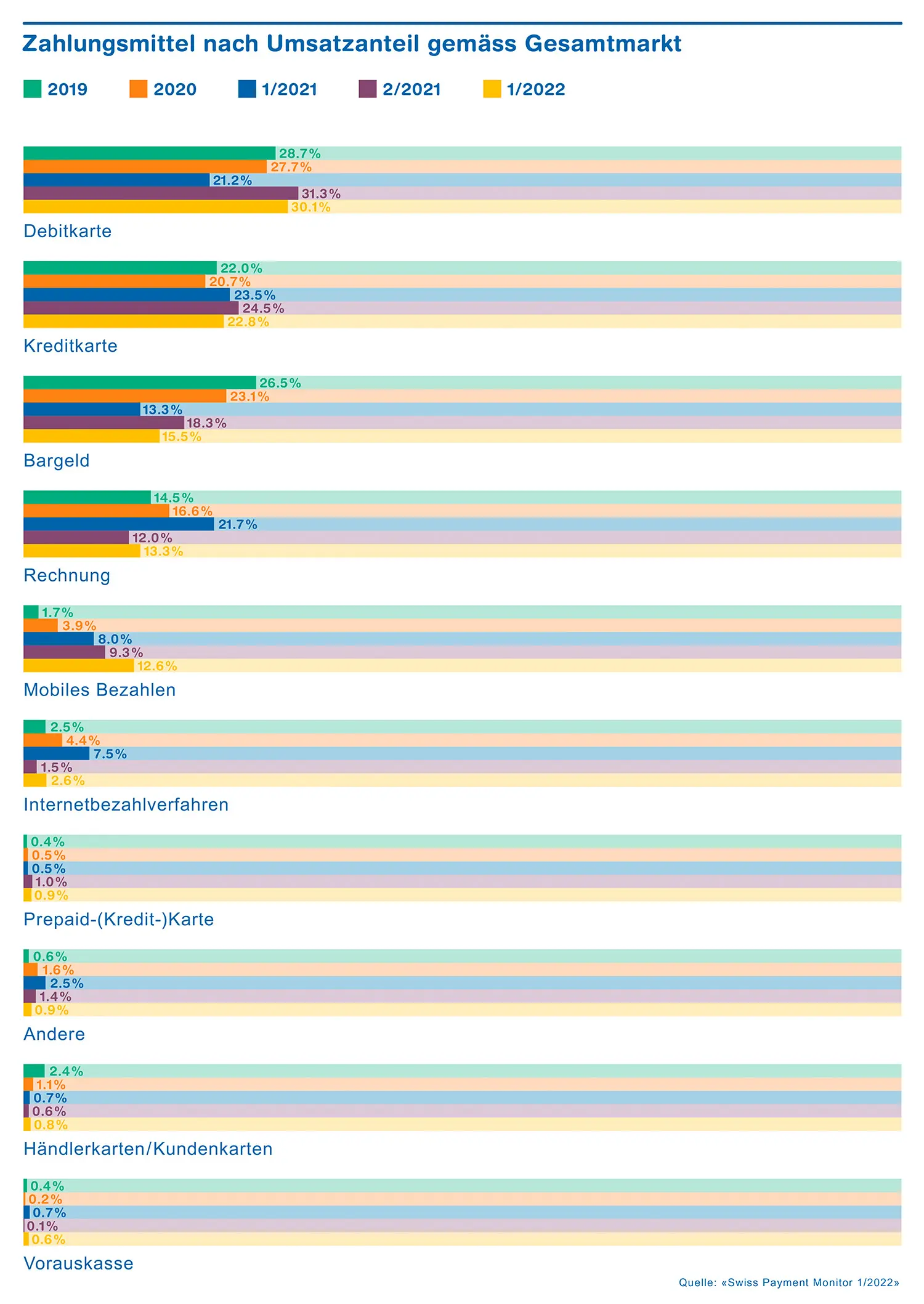

With a share of 32 percent of all transactions (distance and face-to-face business) and 30 percent of corresponding sales, the debit card continues to be the most widely used means of payment overall. However, at 16 percent, cash is losing its share of sales (minus 2.8 percentage points), now occupying third place behind non-mobile credit card use (23 percent). Nevertheless, cash at 30 percent can still hold its own in second place behind the debit card in terms of frequency of use. Non-mobile credit card use follows in third place at 16 percent. "The payment behavior of the Swiss population stabilized in 2021 following sudden changes at the beginning of the pandemic," explains Marcel Stadelmann. "But the popularity of mobile payments continues to grow markedly, with TWINT being by far the most widely used mobile payment solution in Switzerland – accounting for around 60 percent of both revenue and the number of all mobile payments."

Neobanks as an additional solution

Around 30 percent of people in Switzerland have also used new online solutions from neobanks at least once. "In particular, younger men with a high education level are statistically more likely to use neobanks," says Tobias Trütsch, a payment economist at the University of St. Gallen. Revolut is used most often (12 percent), followed by Swiss providers Neon (9 percent) and Zak (8 percent). The vast majority of neobank users take advantage of these services to supplement conventional financial service providers. For example, 2.5 percent of all respondents regularly make payments via neobanks, while just 1.4 percent have most of their money in a neobank account.

E-francs relatively unknown

Around one in 10 survey respondents stated that they know and use virtual or cryptocurrencies like Bitcoin. This share has increased by around four percentage points within a year. However, Central Bank Digital Currency is still relatively unknown among the Swiss population." Although around 14 percent of respondents said they knew this term, only about 5 percent could describe it correctly," according to Tobias Trütsch. Central Bank Digital Currency is the name given to a new form of electronic money issued by central banks and based on blockchain technology. Corresponding solutions are currently being discussed internationally and in Switzerland as the "e-franc."

Swiss Payment Monitor

The Swiss Payment Research Center (SPRC) at the ZHAW School of Management and Law and the Swiss Payment Behaviour Lab at the University of St. Gallen have been working independently on payment-related issues for many years. Together, they have conducted the Swiss Payment Monitor annually since 2018 and twice annually since 2021. When it was first published, this was the only Swiss payment study to combine a consumer perspective with a macroeconomic view. The combination of online survey and diary collection, as well as the link to public data from the Swiss National Bank (SNB), allows the daily use of the means of payment to be depicted realistically. A total of 1,460 people between the ages of 18 and 87 from all three parts of Switzerland were representatively surveyed in 2021 between late October and mid-November. The study is funded by the two Swiss research institutions, the industry association of all major Swiss issuers of credit cards of the international card organizations (Swiss Payment Association), and industry partners Nets and Worldline.

www.swisspaymentmonitor.ch | www.swisspaymentbehaviour.ch

Downloads

- Medienmitteilung «Jede zweite Online-Zahlung erfolgt auf mobilem Gerät»(PDF 433,7 KB)

- Studie «Swiss Payment Monitor 2022 – Wie bezahlt die Schweiz?»(PDF 1,5 MB)

- Infografik «Der Durchschnittsschwerizer...»

- Chart «Zahlungsmittel nach Transaktionsanteil gemäss Gesamtmarkt»

- Chart «Zahlungsmittel nach Umsatzanteil gemäss Gesamtmarkt»

Contacts

Dr. Marcel Stadelmann, Senior Researcher, ZHAW School of Management and Law, Phone +41 (0)58 934 46 46, email: marcel.stadelmann@zhaw.ch

Dr. Tobias Trütsch, Head of Swiss Payment Behaviour Lab, University of St. Gallen, Phone +41 (0)71 224 75 14, email: tobias.truetsch@unisg.ch

Frederic Härvelid, Communicaions, ZHAW School of Management and Law, Phone +41 (0)58 934 51 21, email: frederic.haervelid@zhaw.ch