Prevention and Services: New Insurance Business Models Using Smart Homes as an Example

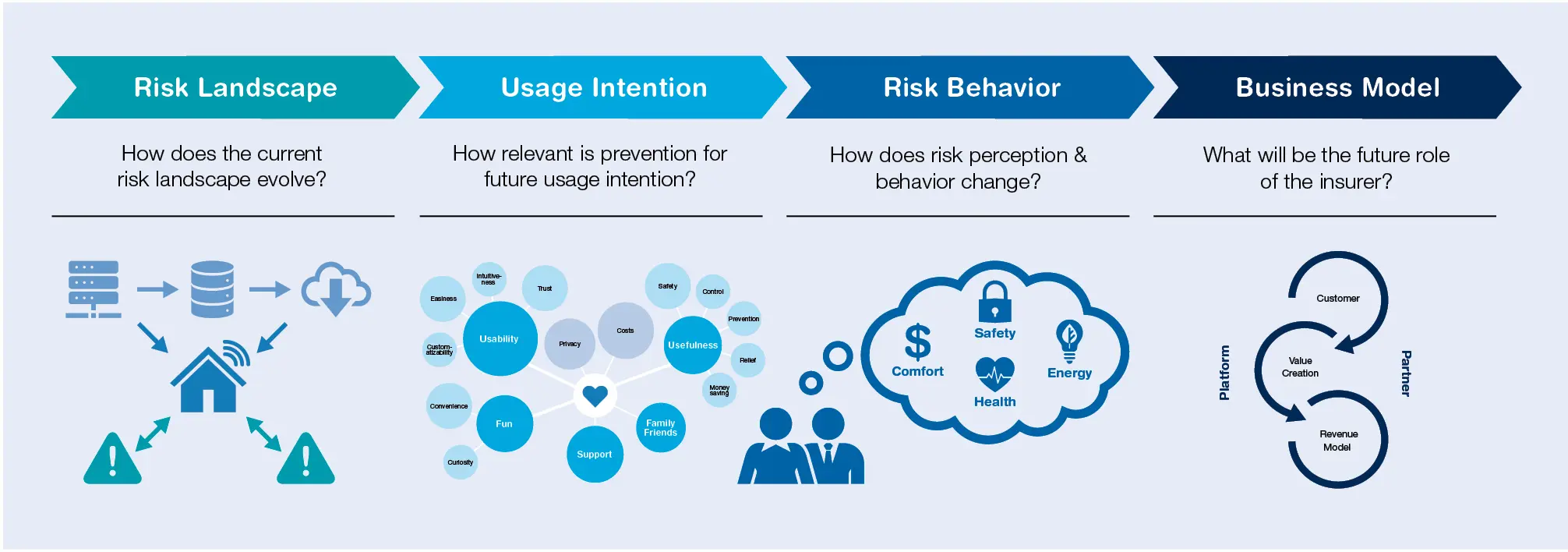

Smart devices find themselves increasingly within one's living environment. Interconnectedness of these devices creates a wide range of possibilities with regard to risk management and prevention. At the Institute for Risk & Insurance of the ZHAW School of Management and Law, we engage in research and consulting on all aspects of risk transformation and risk perception in the Smart Home, as well as on new possibilities for prevention and insurance.

Our research focuses on aspects related to risk transformation, risk perception, and risk management. Accordingly, we position ourselves in the disciplines of risk management and insurance economics. Research partner of the Institute for Risk & Insurance in the field of Smart Home is Prof. Dr. Joël Wagner of the HEC Lausanne. Furthermore, we cooperate with a number of industry partners and public institutions.

Risk Transformation and Perception

Smart Home technologies have the potential to reduce household risks related to fire, water and property damage through prevention and quick action: Real-world experiments demonstrated a reduction greater than 75 percent compared to non-networked households. These systems can also help reduce health risks associated with falls, dementia or support in rehabilitation programs. At the same time, however, new risks emerge - first and foremost those related to cyber. Risk exposure is shifting from the physical to the virtual world. Increasing dependencies and loss of control when using technology also pose additional risks that have yet to be fully addressed.

Projects, publications and contributions on the topic

1 / Artikel: Risikowandel im Smart Home

3 / Vorlesung: Auszug aus der Vorlesung im MBA Real Estate(PDF 1,3 MB)

Prevention and Insurance

The value proposition of Smart Home is inherently preventive. Numerous applications prompt users to invest in preventing and reducing household risks, such as the prevention of burglaries through outdoor-cameras or the early detection of property damage through sensors. Indeed, surveys show that Swiss households see the benefits of Smart Home primarily in the area of security. We studied the extent to which perceived prevention benefit can influence adoption intention of the technology and how Smart Home affect risk perception, risk behavior, and the future demand for insurance coverage. Research evidence suggests a shift from financing the loss event to promoting prevention as well as shifting risk exposure from an indivual risk to the system. The overall impact, however, depends strongly on the design and delivery of the solution and actual usage behavior.

Projects, publications and contributions on the topic

1 / Studie: Smart Home: Ein Ansatz für aktives und gesundes Altern?

Emerging Business Models

With increasing digitalization and greater connectedness between different areas of life, such as living, traveling and working, industry can access more data and exploit these in greater detail. Insurers are introducing new gateways for insurance customers, new pricing models, as well as new services and products related to prevention and risk mitigation. Against this background, our research explores the emergence of new business models in the insurance sector.

Projects, publications and contributions on the topic

1 / Studie: Individualisierte Versicherungslösungen in einer digitalen Welt

2 / Studie: Kurzzeit-Versicherungen: Empirische Untersuchung zu Bekanntheit und Interesse

3 / Publication: On the (future) role of on-demand insurance

4 / Publication: Digital insurance brokers-old wine in new bottles?

5 / Studie: Geschäftsmodelltransformation aus Sicht Risikomanagement(PDF 1,5 MB)

6 / Project: Insurance Intermediation in the age of the Platform Economy

Education and Training

Are you interested in our educational programs? Learn more about us here!

Your contacts for this matter

Prof. Dr. Angela Zeier Röschmann

Professor and Co-Head of the Institute for Risk & Insurance. She lectures and researches on the topics of insurance management, business model innovation and qualitative risk management.

Doctoral student at the Institute of Risk & Insurance. His dissertation is about the risk transformation of Smart Home households.

Lecturer and course director at the Institute for Risk & Insurance. As part of his research activities, he deals with the question of what influence prevention measures have on the frequency and severity of claims in property insurance.

Doctoral student at the Institute of Risk & Insurance. His research focuses on the impact of IoT and Smart Homes technologies as risk prevention measures on the utility and insurance demand.