Prevention and services: New business models in insurance

Driven by loss experience, new technologies or regulation, approaches to preventing and financing risk are changing. This also changes the possibilities and expectations towards insurers. Our research focus on ‘Prevention’ centres on questions relating to the value proposition and demand for insurance with prevention features, as well as the implementation, sustainability and profitability of preventive insurance models. Are you interested in further information or in a collaboration? Please contact Prof. Dr. Angela Zeier Röschmann.

Transformation of risks

Climate risks, digital transformation or demographic change are changing risks as well as risk awareness and behaviour. These developments require adjustments to risk management and also new approaches to insurance.

1 / Publication: On the identification, evaluation and treatment of risks in smart homes

2 / Magazine Article: Risikowandel durch Smart Home

3 / Publication: Green insurance: a roadmap for executive management

Demand for insurance with prevention features

Private households and companies engage in prevention for different reasons, for example as a result of loss experience, regulatory requirements or new technological possibilities. Many insurers have integrated preventive approaches into products and services. However, demand remains limited so far. Whether this is due to insufficient premium incentives, a lack of willingness to share data, a lack of trust in insurers or their data governance, or other factors, is the subject of our research.

1 / Publication: On the adoption of smart home technology in Switzerland: results from a survey study focusing on prevention and active healthy aging aspects.

2 / Publication: Do expectations of risk prevention play a role in the adoption of smart home technology? Findings from a Swiss survey.

3 / Conference: Presentation at the American Risk and Insurance Association (ARIA) conference

Insurance solutions with data-based prevention

Athletes, employees and travelers carry smart devices on them. Households are connected through digital technologies. Vehicles drive semi-autonomously. Companies control processes in an automated, data-based manner. These developments change hazards, risks, and risk management options. For insurers, this development also raises new opportunities for customer interaction, along with questions around product development, risk selection, and loss expectation.

1 / Study in co-operation with SWICA: Smart Home: Ein Ansatz für aktives und gesundes Altern?

2 / Lecture: Smarte Versicherung und Real Estate: Auszug aus der MBA-Vorlesung

4 / Webinar: Versicherung neu gedacht - Versicherung, Prävention und Services im Smart Home

5 / Publication: On IoT-enabled risk prevention and insurance: A systematic literature review

Sustainability, insurability, profitability

Preventive measures and cooperation between various stakeholders are of central importance when it comes to protecting against risks such as floods, cyber or pandemics. Pool solutions, ‘Build Back Better / Stronger’ programmes or investments in nature-based solutions (NBS) are examples of how insurers are getting involved - so far often under the umbrella of sustainability and the pressure of insurability. Our research examines how and under what conditions prevention is becoming a strategic core element of insurers’ business models.

1 / Publication: The role of insurers in flood risk management revisited from a sustainability perspective

3 / Publication: Optimal Government Intervention

Our research partners

Prof. Dr. Joël Wagner der HEC Lausanne

Joint supervision of doctoral students in dissertation projects at the interface of prevention, risk management, and insurance.

The Swiss National Science Foundation (SNSF) is funding the project “Risk perception, mitigation preferences, and value of prevention in smart homes: implications for insurance and risk management” (2023-2026).

Cooperation to advance active aging supported by smart homes: «Smart Home: ein Ansatz für aktives und gesundes Altern?».

Cooperation with the IoT Sustainability Lab, an international research initiative, co-led by ZHAW by Corinna Baumgartner.

Our Methods and Research Design

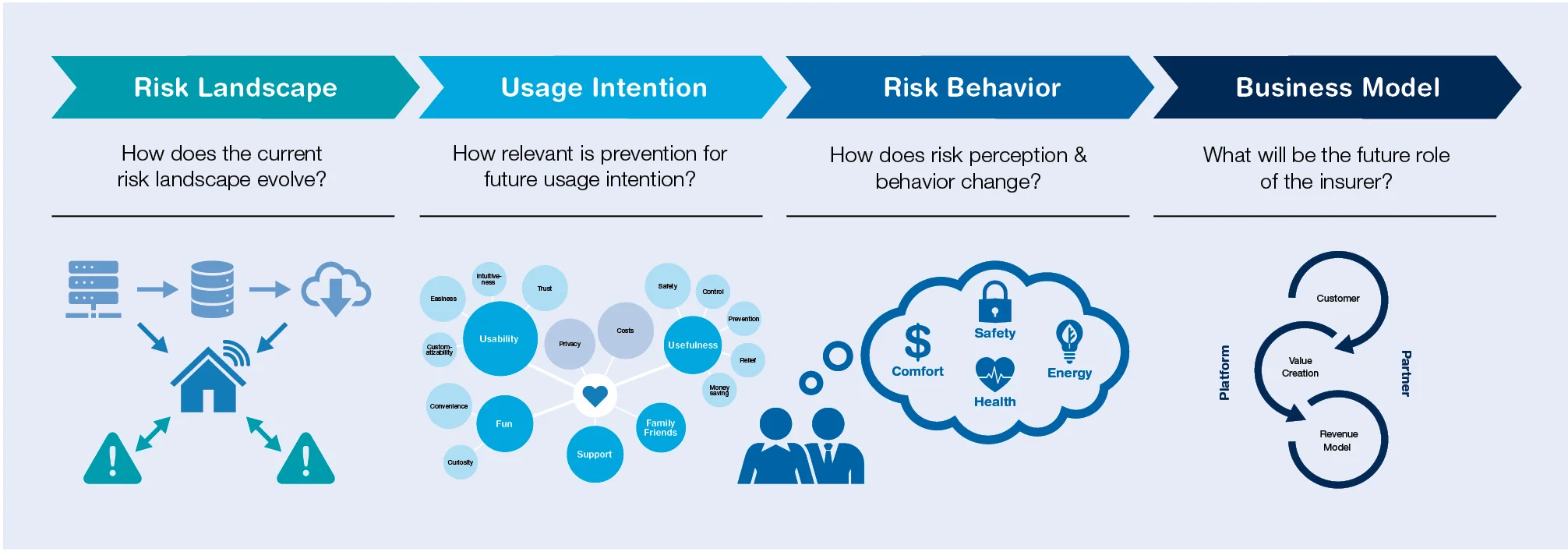

To better understand and anticipate risks, their drivers, and stakeholder expectations, we draw on an increasingly wide range of data. In our research and project work, we use statistical models, simulations, and scenario-based analyses to identify and assess risks, as well as to evaluate demand behavior and market potential. Surveys and experiments provide insights into acceptance, preferences, and customer segments. Qualitative methods such as interviews, workshops, and systematic content and sentiment analyses make perceptions, concerns, and motives visible. Combining these methods creates a robust foundation for the development of business models and prevention strategies.

Contact

Prof. Dr. Angela Zeier Röschmann

Professor und Co-Head of the Institute for Risk & Insurance. She lectures and researches on the topics of insurance management, business model innovation and qualitative risk management.

E-Mail

Lukas Stricker

Lecturer and course director at the Institute for Risk & Insurance. As part of his research activities, he deals with the question of what influence prevention measures have on the frequency and severity of claims in property insurance.

E-Mail

Ion Cimbru

Doctoral student at the Institute for Risk & Insurance. His research focuses on the impact of IoT and Smart Homes technologies as risk prevention measures on the utility and insurance demand.

E-Mail

Dr. Marcel Freyschmidt

Lecturer in Business Mathematics. He lectures and researches on the topics of quantitative risk management and the sustainable management of new risks such as cyber risks, incorporating alternative risk transfer instruments and public-private partnerships.

E-Mail