Finance, Risk & Econometrics

Scientific and technological advancements drive the ongoing automation and digitization in finance and unlock value by new ways of trading, analyzing risk, and forecasting market conditions. Our group turns scientific tools into tailor-made and secure solutions for the financial industry.

Turning Scientific Tools into Tailor-Made Solutions for the Financial Industry

We are a team of mathematicians, physicists, and computer scientists who drive the automation of the financial industry forward. Together with banks, insurers, asset managers, FinTech enterprises and infrastructure providers, we carry out projects to seize the opportunities of the digital transformation.

In our group, financial and technical expertise meet to create solutions that are as simple as possible but as complex as necessary to unlock real value:

- Financial Market Modelling

We use both classic financial models and in-house tools from statistical physics to decode market behavior and generate insights. - Risk Analysis & Systemic Risk

Our data-driven, algorithmic approach to risk is built for the demands of automated and global financial systems. - Blockchains & Distributed Ledgers

We help design secure, scalable ledger infrastructures and work with partners to turn blockchain tech into real-world value. - Time-Series Analysis and Machine Learning in Finance

From simple regressions to deep learning, we apply the right tools to solve financial challenges with precision and expertise. - Commodities, Energy & Alternative Investments

We apply data-driven analyses to develop complementing strategies that navigate markets beyond the traditional ones, including emerging alternative assets.

Research & Projects

We showcase each focus area with currently ongoing projects.

Financial Market Modeling

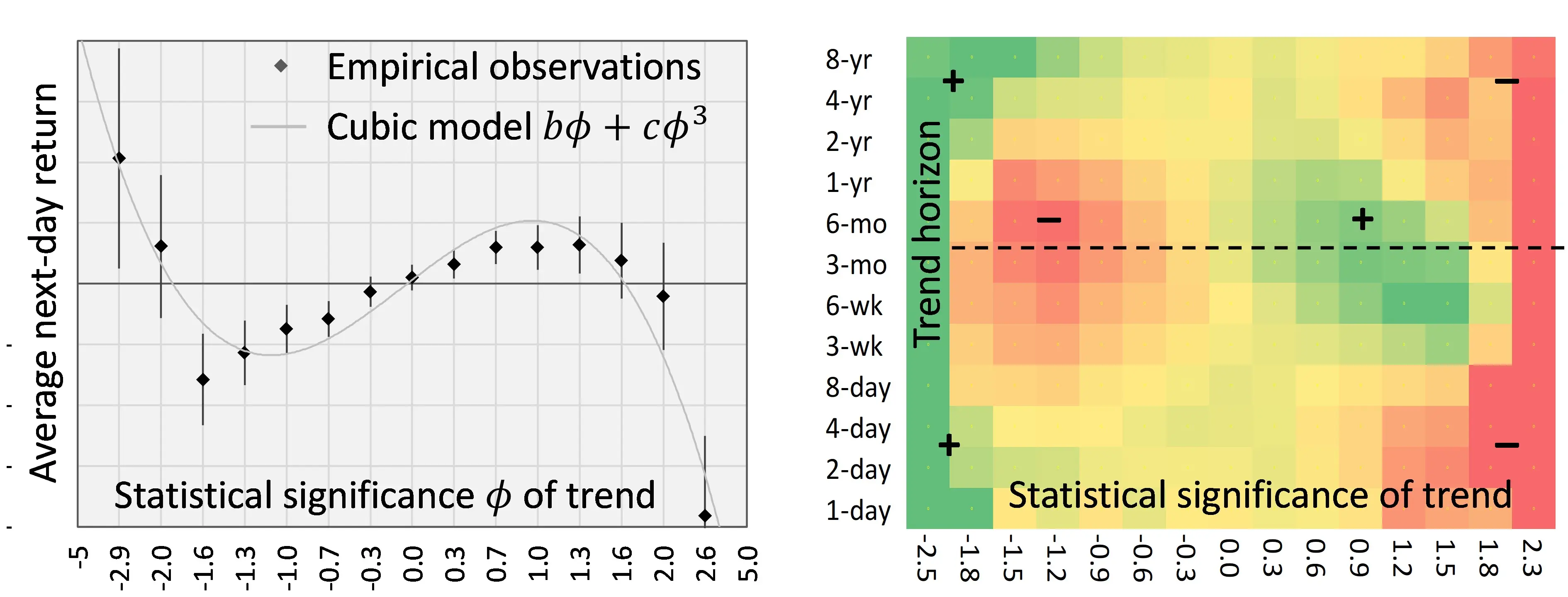

Critical Phenomena in Financial Markets and Social Networks

We investigate the interplay of trends and reversion in the markets is analyzed using 13 years of tick data, 30 years of daily data, 330 years of monthly data, and 800 years of annual data. This leads us to a new lattice gas model of financial markets, where the lattice represents the social network of traders, while the gas molecules are shares of a stock. Using advanced tools of statistical physics and conformal field theory, we use the model to explain the empirically observed scaling behavior of financial markets. We work out applications of the new model in asset- and risk management and, in particular, look for early-warning signals of financial market instabilities.

We expect that our model will lead to a new and deeper understanding and better risk management for financial markets and also for more general social networks.

Publications:

- C. Schmidhuber, Trends, reversion, and critical phenomena in financial markets. Physica A566 (2021).

- C. Schmidhuber, Financial markets and the phase transition between water and steam. Physica A592 (2022).

Team members:

Industry and funding partners:

- SNF Practise-to-Science Grant

Risk Analysis & Systemic Risk

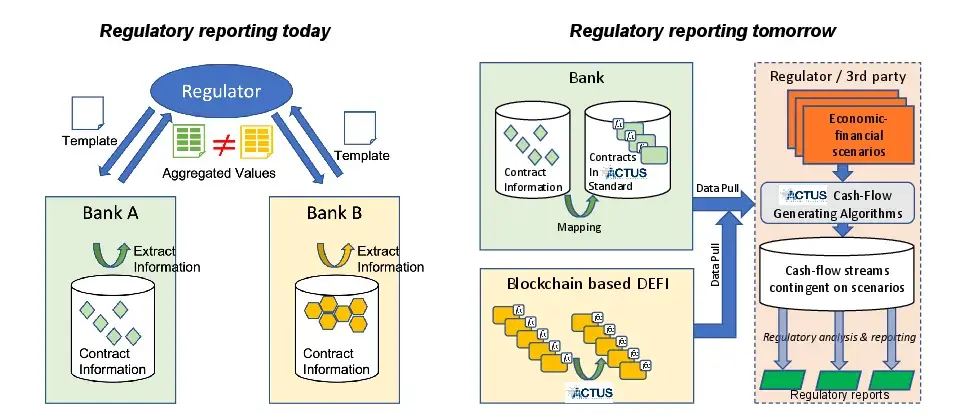

Data Driven Financial Risk and Regulatory Reporting

We are developing a new generation of regulatory technology that has the potential to revolutionize the regulatory reporting practice. The development is carried out in close collaboration with industry and regulators with the aim to create solutions that make a difference for the financial industry and society as a whole.

Publications:

- H. Breymann, P. Hauf and C. Künzle. Venturing into New Ways of Regulatory Reporting and Systemic Risk Analysis. Banking Resilience (Chapter 12), 2024.

Team members:

- Prof. Dr. Henriette Elise Breymann

- Prof. Dr. Tim Weingärtner

- Prof. Dr. Walter Farkas

- Dr. Patrick Hauf

- Dr. Francis Parr

Industry and funding partners:

- SNF BRIDGE

- ACTUS Financial Research Foundation

- ECB

- BrickTowers AG

Blockchains & Distributed Ledgers

Blockchain Security, Economics and Ledger Models

The project's goal is to advance the current state of the art in blockchain design by designing novel components for blockchains systems, including improvements to consensus, to the identity layers, or data protection layers (using zero-knowledge proofs) which align with people's incentives to use the system. The goal is hereby to design secure components not in isolation, but always bearing in mind that using the system also must follow from rational decisions. After all, blockchain systems are a unique blend of security and economic aspects

As these are hard problems at the forefront of blockchain infrastructure development, the results must undergo peer-review. A critical observation in many of the designs aspects, especially when it comes to implementation, is the underlying ledger state representation, be it UTxO-based, account-based, or object-based. Part of this project is to systematically anticipate the practical impact on deploying certain components in various ledger models.

Publications:

- C. Badertscher, M. Campanelli, M. Ciampi, L. Russo, and L. Siniscalchi. Universally Composable SNARKs with Transparent Setup without Programmable Random Oracle. International Cryptology Conference (Crypto) 2025.

- C. Badertscher, F. Banfi and J. Diaz Vico. What Did Come Out of it? Analysis and Improvements of DIDComm Messaging. 2024 ACM SIGSAC Conference on Computer and Communications Security.

Team members:

Industry and funding partners:

- This is a directly financed project with an industry partner.

Time-Series Analysis and Machine Learning in Finance

Forecasting German GDP

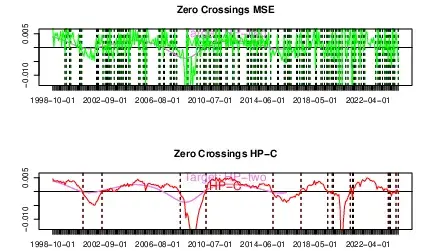

Forecasting German GDP is a collaborative project involving our team as well as IWH (Leibniz-Institut für Wirtschaftsforschung Halle) and CIRET (Montreal). Specifically, our group has developed a novel prediction algorithm that emphasizes mid- to long-term forecast horizons, extending beyond two quarters. While traditional forecast optimization criteria often focus on a single objective—such as minimizing mean squared error (MSE)—we introduce a new Smooth Sign Accuracy (SSA) approach that concurrently evaluates sign accuracy, MSE, and the frequency of zero-crossings in predictions. Zero-crossings, which represent sign changes in the stationary growth rate of a non-stationary time series, serve as crucial indicators of transitions between expansion and contraction phases, playing a vital role in decision-making and control processes. The SSA framework effectively captures and balances these diverse aspects by explicitly recognizing the inherent trade-off—termed the accuracy-smoothness (AS) dilemma—faced by predictors.

Team members:

Additional Links:

Commodities, Energy, and Alternative Investments

Commodities and Alternative Investment Strategies

A common theme across the different research projects is empirical analysis of (private or public) financial data, where the work typically explores new or alternative methods with respect to established industry standards. This require both methodology and data modelling expertise as well as industry experience with financial data in the given context, to produce reliable and actionable results.

Within the area of Commodity and Alternative Investments, the research often concerns different market factors that are central to the given investment or trading thesis. For example, this could be a quantitative study of a fundamental factor associated with supply and demand expected to impact the market of a commodity, or a technical factor used in the hypothesis behind a systematic risk-premia/QIS strategy. Another common subject is risk within this specific context. This could relate to individual markets, such as exploring a hedging approach or a quantitative risk metric, as well as portfolio risk where the circumstances related to a commodity or alternative investment portfolio may align better with a customized approach.

Team members:

Teaching

Lectures

We teach students basic and advanced concepts and tools in finance & risk, time series, and blockchain technology over a series of lectures. We further teach students the basics of business concept creation and planning. We serve multiple study programs at the School of Engineering, in particular Engineering & Management (EM) and Data Science (DS).

- Mathematics of Financial Markets (MF1 & MF2) for EM

- Risk Engineering (RE) for EM

- Financial Enterprise Modeling (FUM) for EM

- Time-Series (TS), Time-Series Prediction (TSP), Advanced Time Series in Finance (ATSF) for EM

- Blockchains and Distributed Ledger Technology (BDL) for all of SoE

- Introduction to Financial Markets (EFM) for DS

- Adaptive Models (AMO) for DS

- Project Modules (PM3 & PM4) for EM

- Current Topics in Blockchains and Distributed Ledger Technology (Additional Course (EVA)) in the master's program MSE)

CAS & Continuing Education

We are part of the continuing education programs at ZHAW.

Student-Project Offers

We present here a brief overview of selected open student projects and thematic areas. Make sure to check Complesis to see all projects our group is currently offering.

You would like to follow your own project for the bachelor (PA/BA) or master (VT/MT)? Don't hesitate to contact us!

Currency Exposure in a Macro Portfolio

Contact: Stefan Ask

Macro investors often combine strategies investing in both FX rates as well as commodities. These instruments are typically prices in USD per unit of commodity or foreign currency, resulting in the common base currency acting as a confounding factor across portfolio assets, in addition to other sources of statistical correlation. This project intends to analyze the correlation structure within, as well as between, a FX rate and a Commodity portfolio to gain insight about how to construct a diversified portfolio in this scenario.

Automation in Finance using ACTUS and Blockchain

Contact: Christian Badertscher & Henriette Breymann

In this thematic area, we work toward full automation in finance using modern analytical frameworks to algorithmically capture financial instruments (using ACTUS), conduct analyes, and eventually run the contracts on-chain. The projects are interdisciplinary and multi-faceted and students can dive into specific sub-topics for their project.

Success Stories

We provide here a few examples of past successful student projects conducted in our group.

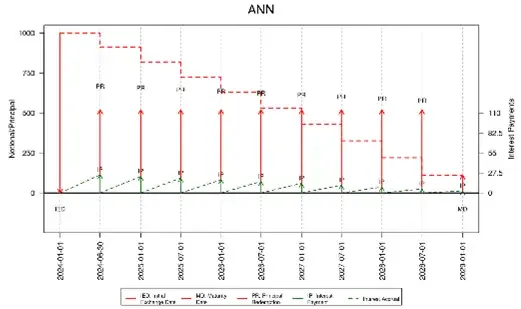

Forward Looking Analysis of the Largest Granular Loan Database in the Euro Area

Supervisor: Prof. Dr. H. Breymann

Student: Donat Maier

ECB’s AnaCredit is the largest granular loan database in the euro area. In this project, the loans were analyzed under 100 interest rate scenarios using ACTUS and DaDFiR3 Technology to provide new perspectives on their cash flow patterns.

Title: Enhancing Trust in Blockchain Data Imports via Context-Aware Validation Layers

Supervisor: Christian Badertscher

Students: Nathan Hess, Alexis Tziantopoulos

In this Bachelor's thesis, which started as a project thesis before, a system is developed that establishes high reliability of imported external data into blockchains needed in financial applications. The system uses machine learning techniques and embeds the data point into its context to detect unusual patterns.

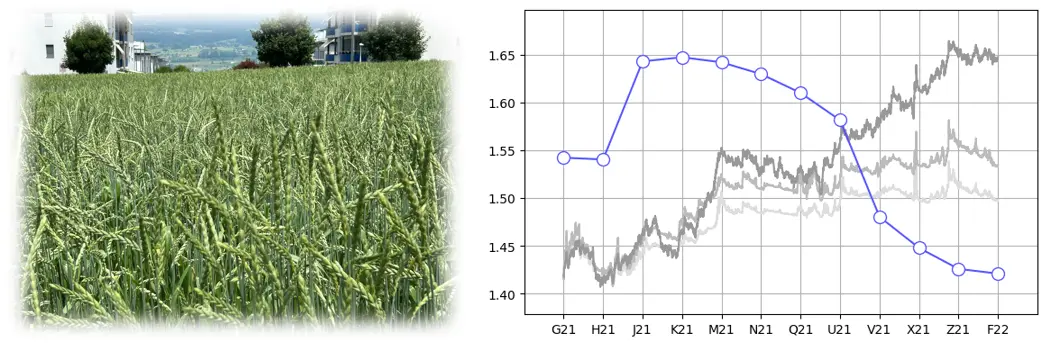

Title: Momentum and Carry in Commodity Futures

Supervisor: Stefan Ask

Student: Mike Gasser

Futures are commonly used to get investment exposure to commodities, while avoiding the practical implications from holding the physical assets. Momentum and carry are common trading strategies, which are conceptually different, however, historically often show a significant overlap in their performance. This project will quantify as well as explore the potential reasons for their performance overlap for the case of commodity futures.

Title: Towards Optimized AI Strategies for Cryptocurrency Trading

Supervisors: Christian Badertscher, Jasmina Bogojeska

Students: Mikail Memis, Trojan Veseli

In this Bachelor's thesis, a novel architecture for AI-powered cryptcurrency trading is developed and evaluated, based on the recently proposed time-series analysis model TimesNet, in combination with double-deep Q-learning. The study shows remarkable results confirming recent studies with traditional stocks.

Team

“Great things in business are never done by one person, they are done by a team of people” ― Steve Jobs.