Online shopping abroad increasingly popular with the Swiss

The ZHAW and HWZ have surveyed Swiss online retail providers and customers on behalf of Swiss Post. The studies show that Swiss online retailers increasingly need to offer value-added services to face the competition from abroad.

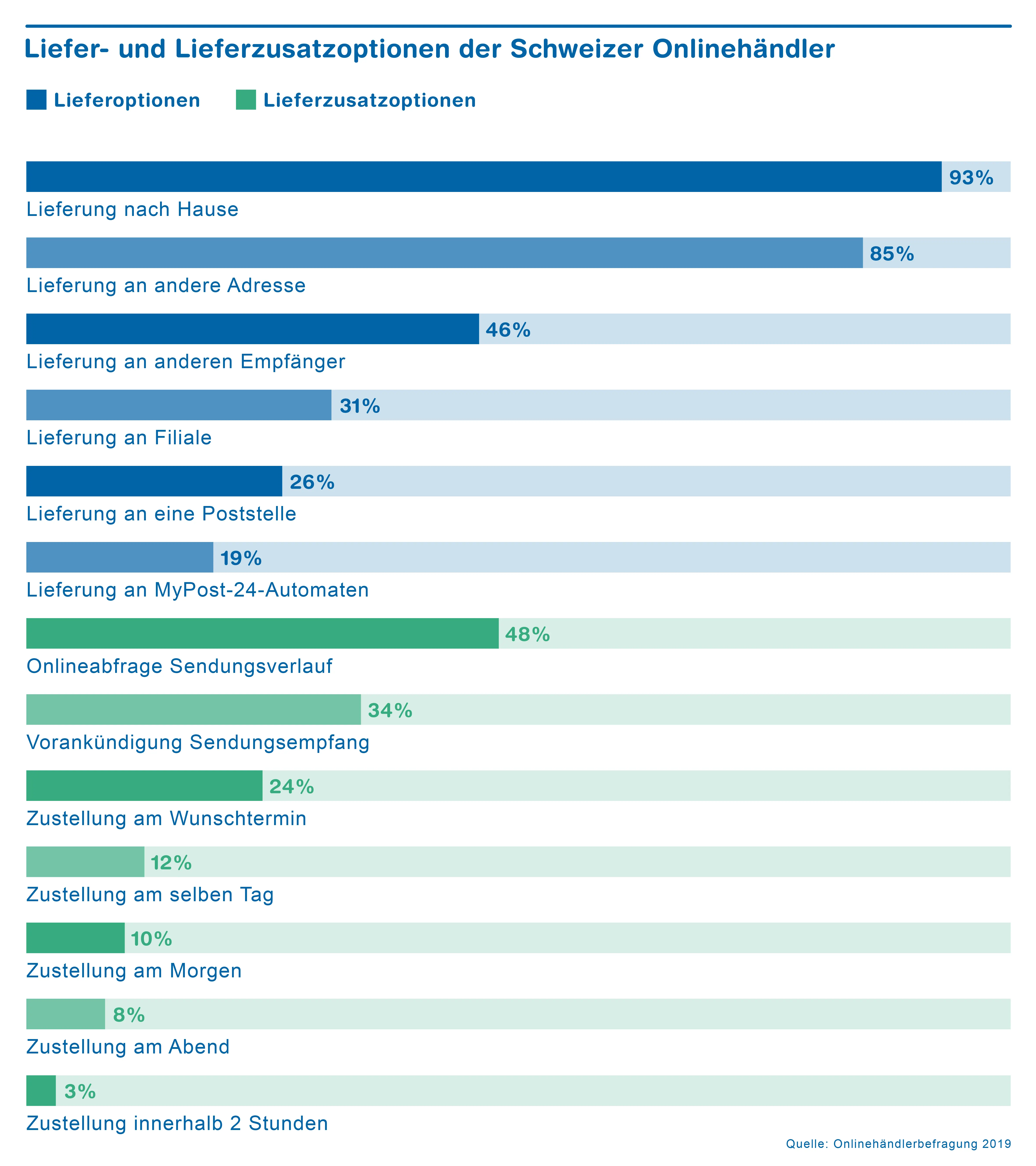

Swiss online retailers frequently offer value-added services such as online track and trace (48 percent) and notification of consignment delivery time (34 percent). The proportion of online retailers offering free shipping (2019: 54 percent; 2018: 51 percent) and free returns (2019: 28 percent; 2018: 25 percent) has also increased slightly year-on-year. This trend was shown in the Swiss online retailer survey conducted in 2019 by the ZHAW School of Management and Law on behalf of Swiss Post. It indicates that Swiss online retailers are responding to the increasing popularity of foreign marketplaces like AliExpress. These value-added services are growing in significance for online customers: track and trace (76 percent) and advance notice of consignments (74 percent) are very important to online shoppers while same-day delivery is less so. These are some of the findings in the e-commerce trend indicator compiled by the HWZ University of Applied Sciences in Business Administration Zurich.

More and more people are shopping on foreign marketplaces

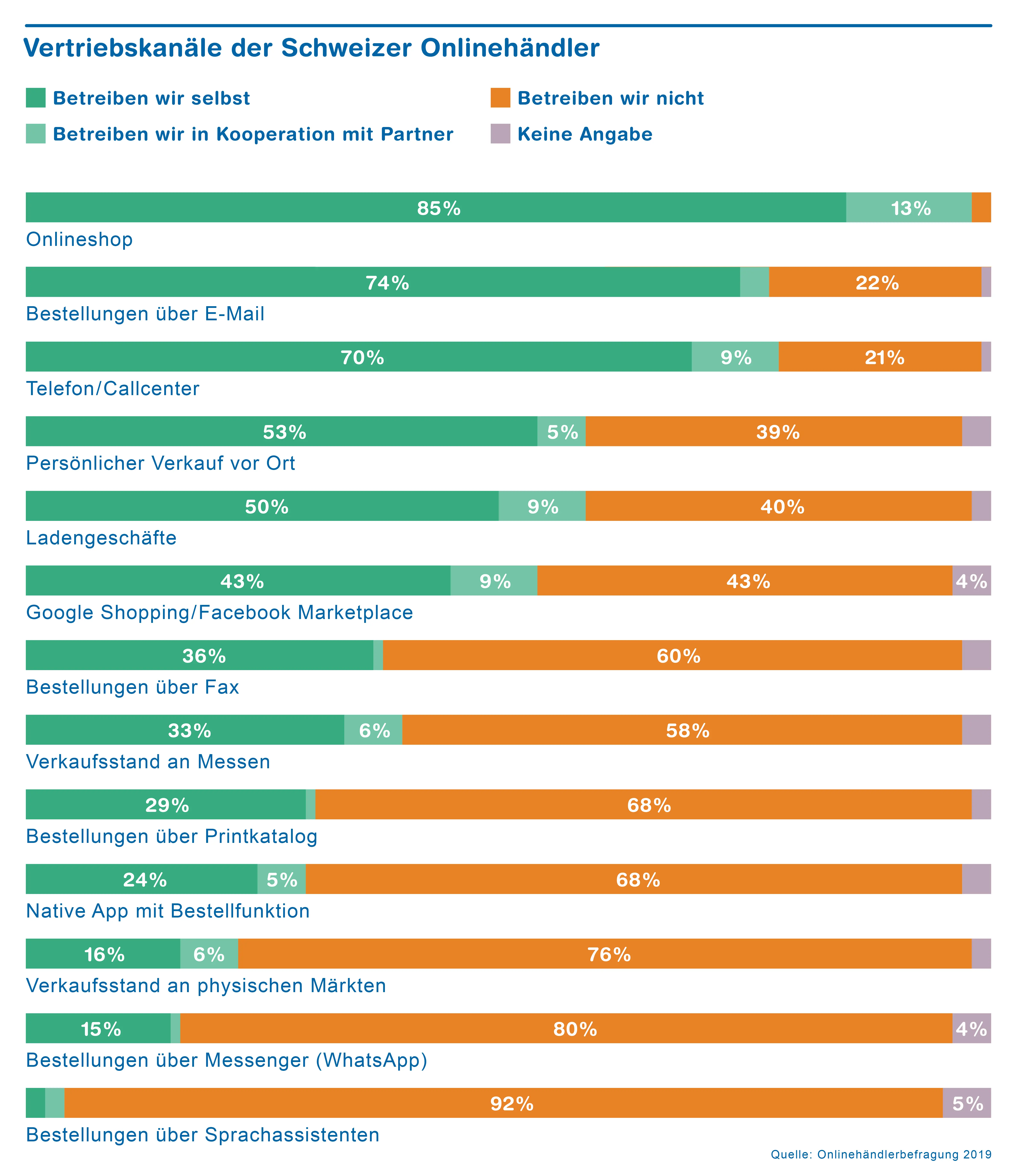

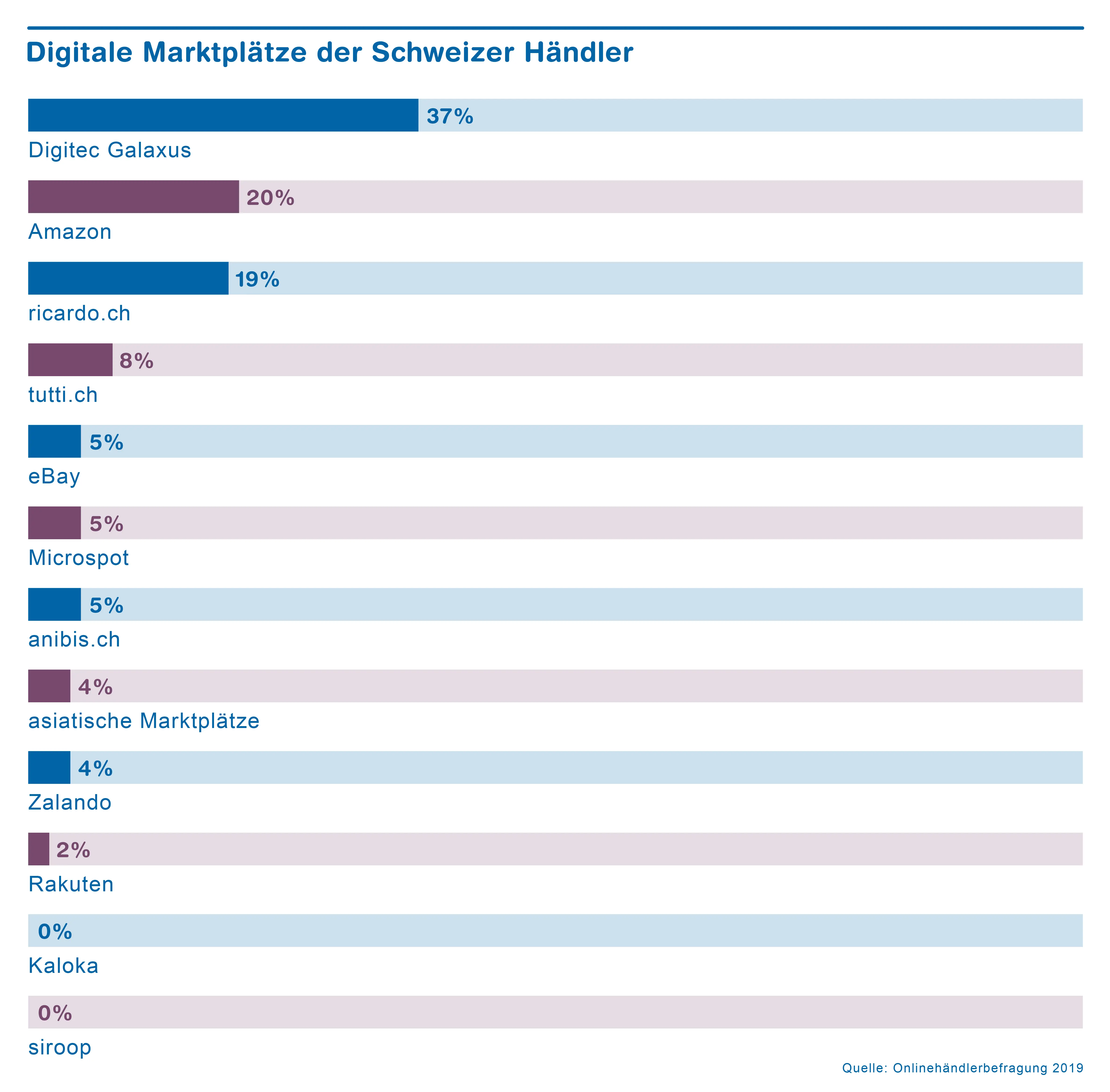

35 percent of online retailers make use of additional digital marketplaces to generate sales, primarily via Digitec or Galaxus. Digitec Galaxus AG was able to acquire an even greater market share year-on-year after the discontinuation of Siroop (2019: 37 percent; 2018: 34 percent). 33 percent of online retailers use digital marketplaces to make their entry into the foreign market easier. Half of retailers are selling via Google Shopping and Facebook Marketplace besides their own online shops, marketplaces and retail spaces. “Swiss online retailers are also increasingly selling via messenger services such as WhatsApp”, explains the author of the study, Darius Zumstein from ZHAW. According to the survey, this already accounts for a sixth of providers. Special shopping days are also popular among online retailers with almost half taking part in Black Friday.

Among consumers, Ricardo (80 percent), Amazon (76 percent) and Digitec Galaxus (67 percent) are still far more popular than providers of Asian goods such as Wish (40 percent) and AliExpress (2019: 35 percent; 2016: 21 percent). That said, shopping for Asian goods on foreign marketplaces has gained acceptance among Swiss consumers. By contrast, fewer purchases are being made on eBay (2019: 49 percent; 2016: 58 percent).

User friendliness is becoming less of a hurdle to online shoppers in the shopping process (2019: 53 percent; 2016: 66 percent). Purchases by smartphone are also becoming much easier. 45 percent of online retailers, for example, already offer mobile payment such as via TWINT (2019: 31 percent; 2018: 24 percent). This corresponds to rising demand from customers, who increasingly prefer to pay by smartphone: in 2016 this share was only 6 percent but in 2019 it is now 23 percent. The analyses show that mobile payment options are ex-panding at the expense of invoices (2019: 75 percent; 2016: 85 percent). But payment by in-voice and by credit card are still the standard payment options in online shops (both 83 percent). This meets the needs of consumers who are particularly interested in convenient payment processing (87 percent) and who mainly pay by invoice or credit card.

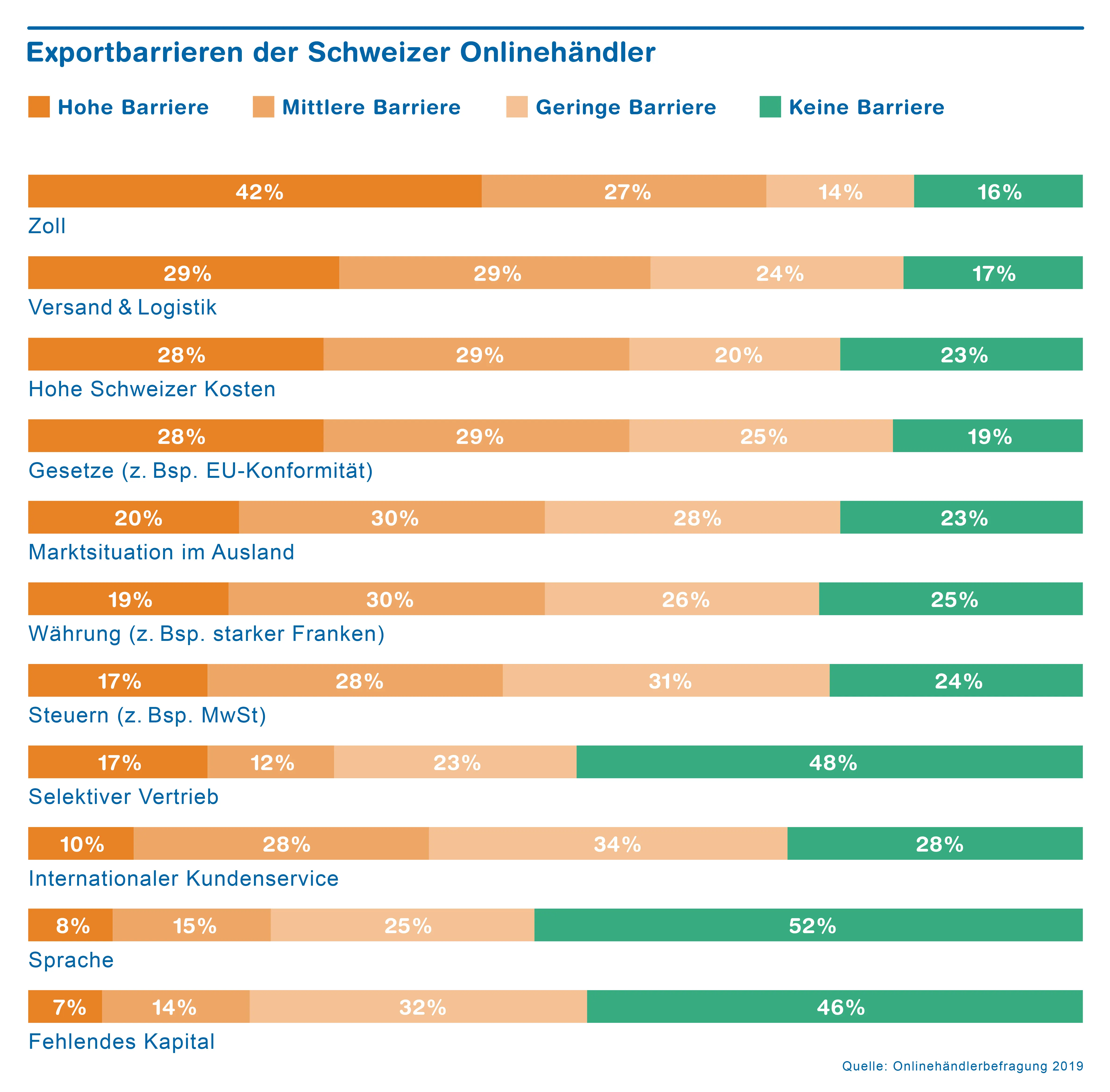

There are high export barriers

More than 74 percent of Swiss online retailers predominantly buy their products in Switzerland because the barriers to exporting are high. Customs duty (69 percent), shipping and logistics (58 percent) and high salary and storage costs in Switzerland (57 percent) are considered to be challenges to international sales. According to Zumstein, “Customs duty and customs processing are the biggest hurdle to exporting”. “Foreign laws also make it difficult for Swiss manufacturers and retailers to export goods.” By contrast, it seems unimportant to most Swiss consumers whether goods are purchased in Switzerland or online from abroad: 70 percent of those surveyed have made purchases in German online shops in the last twelve months and 41 percent from Chinese shops.

For additional, more detailed results visit: «Here’s what makes Swiss online retail tick»

Information on the studies

Swiss online retailer study 2019

The study was conducted by the ZHAW School of Management and Law (Institute for Marketing Management) on behalf of Swiss Post. The aim of the study is to gather and analyse the views of online retailers and their assessment of digital commerce. A quantitative empirical study was chosen as the research approach. The online survey was carried out in mid-2019. More than 279 Swiss online retailers participated in the survey.

Swiss e-commerce trend indicator 2019

The study was drawn up by the Institute for Digital Business at the HWZ University of Applied Sciences in Business Administration Zurich in conjunction with Swiss Post and has been conducted annually since 2015. The purpose of the study is to record and analyse the trends and habits of customers in the Swiss e-commerce market. A quantitative empirical study was chosen as the research approach. The survey was conducted using an online questionnaire and took place in June 2019. After cleaning the data, the sample comprised 14,326 participants.

Downloads

[Translate to english:]

- Medienmitteilung: Onlineshopping im Ausland bei Schweizerinnen und Schweizern immer beliebter (PDF 81 kB)

- Press release: Online shopping abroad increasingly popular with the Swiss (PDF 108 kB)

- Communiqué de presse: Popularité accrue des achats en ligne à l’étranger auprès des Suisses et des Suissesses (PDF 142 kB)

- Comunicato stampa: Acquisti online all’estero sempre più popolari fra gli svizzeri (PDF 203 kB)

- Chart: Exportbarrieren der Schweizer Onlinehändler (JPG 2.48 MB)

- Chart: Vertriebskanäle der Schweizer Onlinehändler (JPG 2.94 MB)

- Chart: Digitale Marktplätze der Schweizer Händler (JPG 1.38 MB)

- Chart: Liefer- und Lieferzusatzoptionen der Schweizer Onlinehändler (JPG 2.35 MB)

- Chart: Vorteile- und Herausforderungen im Schweizer Onlinehandel (JPG 1.24 MB)

- For additional, more detailed results visit: «Here’s what makes Swiss online retail tick»

Contact

- Darius Zumstein, ZHAW School of Management and Law, Institute for Marketing Man-agement, telephone +41 58 934 66 08, e-mail: darius.zumstein@zhaw.ch

- Manuel P. Nappo, Head of the Institute for Digital Business, HWZ University of Applied Sciences in Business Administration Zurich, telephone +41 43 322 26 30, e-mail: manuel.nappo@fh-hwz.ch

- ZHAW Corporate Communications, telephone +41 58 934 75 75, e-mail: medien@zhaw.ch

- Jacqueline Bühlmann, Swiss Post Media Unit, telephone +41 58 341 37 80, e-mail: presse@post.ch