European government bond dynamics and stability policies: taming contagion risks

Dynamic correlation networks of European sovereign bonds

At a glance

- Project leader : Dr. Martin Hillebrand, Prof. Dr. Peter Schwendner

- Project team : Dr. Martin Schüle

- Project status : completed

- Funding partner : EU and other international programmes

- Project partner : European Stability Mechanism ESM

- Contact person : Peter Schwendner

Description

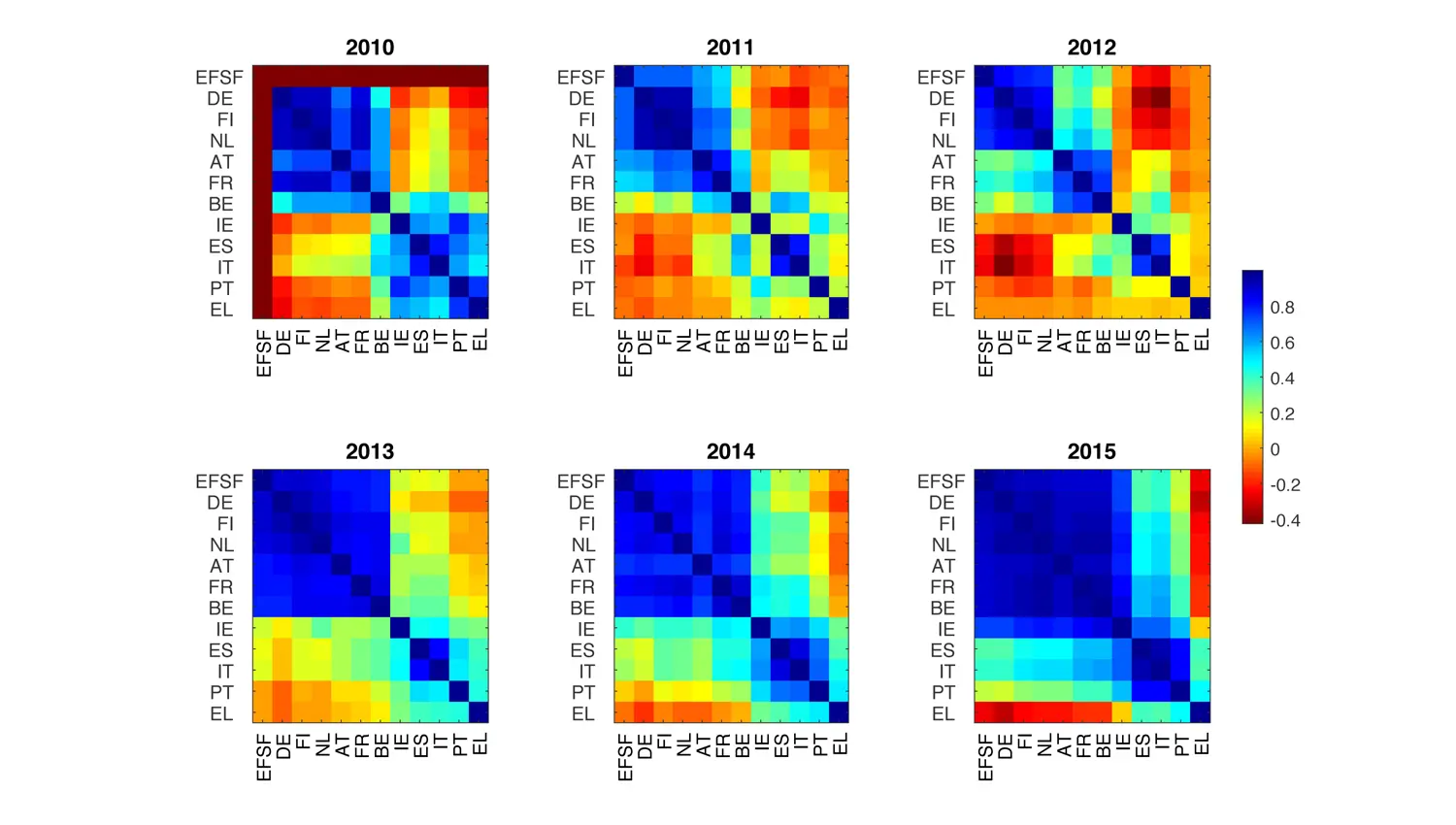

From 2004 to 2015, the market perception of the sovereign risks of euro area government bonds experienced several different phases, reflected in a clear time structure of the correlation matrix between the yield changes. “Core” and “peripheral” bonds cluster in a bloc-like structure, but the correlations between the blocs are time-dependent and even become negative in periods of stress.

Using noise-filtered partial correlation influences, this time-dependency can be evaluated and visualized using network graphs. Our results support the view that market-implied spillover risks have decreased since the European rescue and stability mechanisms came into force in 2011. EFSF bond issues have been trading as part of the “core” bloc since 2011.

In 2015, spillover risks reappeared during the Eurogroup’s negotiations with Greece, although the periphery yields did not show risk spreads that were as large as those in 2012.

Further information

Publications

-

Schüle, Martin; Schwendner, Peter,

2016.

European government bond dynamics and stability policies : taming contagion risks.

In:

9th Financial Risks International Forum, Paris, France, 21 March 2016.

-

Schwendner, Peter; Schüle, Martin; Ott, Thomas; Hillebrand, Martin,

2015.

European government bond dynamics and stability policies : taming contagion risks.

Journal of Network Theory in Finance.

1(4), pp. 1-25.

Available from: https://doi.org/10.21314/JNTF.2015.012

-

2015.

European government bond dynamics and stability policies : taming contagion risks [poster].

In:

6th ESOBE Conference «Complexity in Economics», Gerzensee, 29. Oktober 2015.

-

Kelly, Scott; Chaplin, Andrew; Coburn, Andrew; Copic, Jennifer; Evan, Tamara; Neduv, Eugene; Ralph, Daniel; Ruffle, Simon; Schwendner, Peter; Skelton, Andrew; Yeo, Jaclyn Zhiyi,

2015.

Stress test scenario : eurozone meltdown.

Cambridge:

Cambridge Centre for Risk Studies.

Available from: https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/risk/downloads/crs-eurozone-meltdown-financial-catastrophe.pdf