Hydropower reserve by means of tradeable obligations

Within the context of rising electricity prices, the storage reserve that the federal government wishes to procure via an auction will likely be very expensive. In the following article, we propose an alternative instrument for procuring this reserve.

By Ingmar Schlecht (ZHAW CEE) and Jonas Savelsberg (ETH Zurich).

Hydropower reserve. The Federal Council would like to introduce a hydropower reserve and adopted an ordinance to this end at its meeting on 7 September 2022. Hydropower plant operators are to be paid to leave a certain minimum amount of water in their reservoirs during winter and spring (from 1 December until 15 May) in order to ensure that it is ready for use in the event of a crisis. The reserve is to be procured as part of a tender process in which operators can submit bids. Based on the bid prices and the volume procured, the total costs of the reserve, which are to be paid for by consumers through grid charges, will be calculated.

Reserve becoming more expensive. The costs for the procurement of the reserve will be considerably higher than they would have been prior to the energy crisis. This is due to the spike in electricity prices brought about by the crisis. The Federal Council currently expects costs of between CHF 650 million and CHF 750 million, which equates to approximately CHF 80 per resident for the winter.

Windfall profits for hydropower due to the energy crisis. Against the backdrop of rising electricity prices, a discussion has arisen in the EU about the redistribution of crisis-related windfall profits to electricity consumers. Following proposals from Greece and Spain, the EU Commission will also put forward its own proposals on 14 September. In the medium term, increased electricity prices and greater price differences between high and low price periods will also result in significant profits for the operators of Swiss hydropower plants, as electricity prices for future years, some of which have not yet been marketed on a forward basis, are also well above the historical average.

Market power. Under the approach envisaged by the Federal Council, which will see the reserve procured via an auction, there is the problem that individual providers have a considerable degree of market power and can raise prices above a competitive level. As the Swiss market is relatively small with a high level of market concentration and the reserve is to be distributed over a high proportion of the total capacity on the market, it is especially exposed to the problem of market power (we have already made reference to this in the past). The hydropower reserve thus threatens to place a further burden on consumers at a time of high electricity prices – and therefore (for future years) high profits for the Swiss hydropower sector. In light of this situation, the Federal Council could look to organise the procurement of the reserve differently in order to limit market power and keep costs low for consumers.

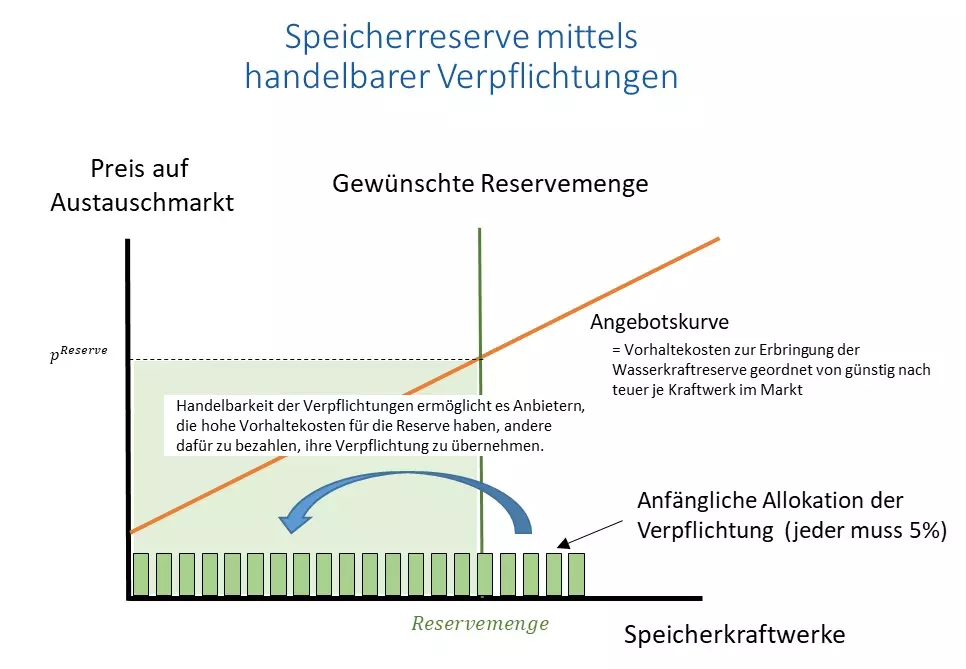

Tradeable objectives. One way of doing so would be to procure the reserve through tradeable obligations, a subject we go into below in greater detail. Given the current special situation, the idea would be to forego remuneration and instead organise the reserve by means of an obligation on the part of the reservoir operators. However, this obligation is tradeable, meaning that reservoir operators can trade the obligation among themselves and pass it on to other reservoir operators, giving rise to an allocation in which those reservoir operators who can do so most cheaply provide the reserve. The result would thus be an efficient market outcome that is also free for the consumer in the short term. (While costs would be passed on to consumers over the long term in a normal situation, this is not the case in a scenario with short-term windfall profits.)

How it works. Procurement by means of tradeable obligations could work as follows.

- Each hydropower plant is initially given the obligation to retain, for example, 5% of its reservoir volume for the storage reserve.

- This obligation is tradeable (on a simple bilateral basis, meaning no costly centralised trading). Those power plants that don’t wish to meet this obligation can thus pay other power plants to take it on. This makes the allocation efficient.

- The regulator has to be provided with final notification of who will assume the obligation on, for example, 1 December 2022.

- The result is an efficient allocation (similar to a tender process) that avoids the market power issue that an auction would entail.